Aging Population

The increasing aging population is a primary driver for the Patient Handling Equipment Market. As individuals age, they often require assistance with mobility and daily activities, leading to a heightened demand for patient handling solutions. According to demographic data, the proportion of individuals aged 65 and older is projected to rise significantly, which correlates with an increased prevalence of chronic conditions that necessitate patient handling equipment. This demographic shift compels healthcare facilities to invest in advanced equipment to ensure safe and efficient patient transfers, thereby enhancing care quality. The market for patient handling equipment is expected to expand as healthcare providers seek to accommodate the needs of this growing segment of the population, indicating a robust growth trajectory for the industry.

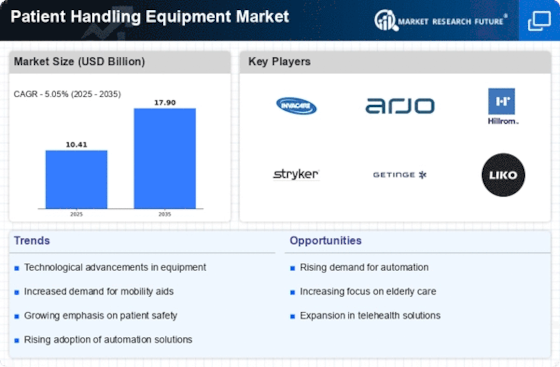

Technological Advancements

Technological advancements play a pivotal role in shaping the Patient Handling Equipment Market. Innovations such as automated lifts, smart beds, and advanced mobility aids are revolutionizing the way patient handling is approached. These technologies not only improve efficiency but also enhance the overall patient experience by providing greater comfort and safety. Market data indicates that the integration of technology in patient handling equipment is becoming increasingly prevalent, with manufacturers focusing on developing solutions that incorporate smart features and connectivity. As healthcare providers seek to leverage these advancements to optimize their operations, the demand for technologically advanced patient handling equipment is likely to surge, driving industry growth.

Rising Healthcare Expenditure

Rising healthcare expenditure is another critical driver influencing the Patient Handling Equipment Market. Governments and private sectors are increasingly allocating funds to improve healthcare infrastructure, which includes the procurement of patient handling equipment. Data suggests that healthcare spending has been on an upward trend, with many countries investing in modernizing their facilities to enhance patient care. This financial commitment not only facilitates the acquisition of advanced patient handling solutions but also promotes the adoption of innovative technologies that improve operational efficiency. As healthcare budgets expand, the demand for high-quality patient handling equipment is likely to increase, positioning the industry for sustained growth in the coming years.

Increased Focus on Patient Safety

An increased focus on patient safety is driving the Patient Handling Equipment Market. Healthcare providers are prioritizing the implementation of equipment that minimizes the risk of injury to both patients and caregivers during transfers and mobility assistance. This emphasis on safety is reflected in the adoption of ergonomic designs and advanced technologies that enhance the user experience. Regulatory bodies are also establishing stringent guidelines to ensure that patient handling equipment meets safety standards, further propelling market growth. As healthcare facilities strive to create safer environments, the demand for reliable and efficient patient handling solutions is expected to rise, indicating a positive outlook for the industry.

Regulatory Compliance and Standards

Regulatory compliance and standards are significant drivers of the Patient Handling Equipment Market. Governments and health organizations are establishing regulations to ensure that patient handling equipment meets safety and quality benchmarks. Compliance with these regulations is essential for healthcare facilities, as it directly impacts their operational capabilities and patient care quality. The need to adhere to these standards compels healthcare providers to invest in compliant equipment, thereby stimulating market demand. As regulatory frameworks evolve, the emphasis on quality and safety in patient handling equipment is expected to intensify, further propelling the growth of the industry.