Innovations in Composite Materials

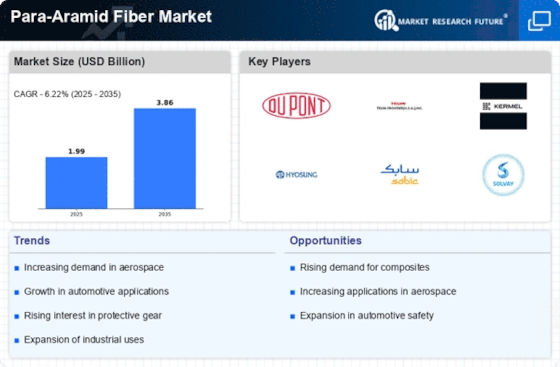

The Para-Aramid Fiber Market is poised for growth due to innovations in composite materials. The integration of para-aramid fibers into composite structures enhances mechanical properties, making them suitable for a variety of applications, including automotive and construction. These composites exhibit improved strength, reduced weight, and enhanced durability, which are critical factors in modern engineering. Recent studies indicate that the composite materials market is projected to grow at a CAGR of approximately 6% over the next five years, suggesting a robust opportunity for para-aramid fibers. As industries increasingly seek lightweight and high-strength materials, the role of para-aramid fibers in composite applications is likely to expand, further driving market growth.

Rising Demand in Aerospace and Defense

The Para-Aramid Fiber Market is experiencing a notable surge in demand, particularly within the aerospace and defense sectors. This increase is largely attributed to the material's exceptional strength-to-weight ratio and its ability to withstand extreme temperatures. As military and aerospace applications require materials that can endure harsh conditions while maintaining structural integrity, para-aramid fibers are becoming increasingly indispensable. Recent data indicates that the aerospace sector alone is projected to grow at a compound annual growth rate of approximately 5.5% through 2027, further driving the demand for para-aramid fibers. Consequently, manufacturers are focusing on enhancing production capabilities to meet this burgeoning need, thereby solidifying the position of para-aramid fibers in these critical industries.

Growth in Personal Protective Equipment

The Para-Aramid Fiber Market is significantly influenced by the escalating demand for personal protective equipment (PPE). As safety regulations become more stringent across various industries, the need for high-performance materials that offer protection against cuts, abrasions, and heat is paramount. Para-aramid fibers, known for their durability and resistance to heat, are increasingly utilized in the production of gloves, vests, and other protective gear. Market analysis suggests that the PPE sector is expected to expand at a rate of around 7% annually, which is likely to bolster the para-aramid fiber market. This trend indicates a growing recognition of the importance of safety in workplaces, thereby enhancing the relevance of para-aramid fibers in the PPE market.

Increased Investment in Research and Development

The Para-Aramid Fiber Market is benefiting from increased investment in research and development (R&D). Companies are focusing on developing advanced para-aramid fiber products that offer enhanced performance characteristics, such as improved thermal stability and chemical resistance. This trend is particularly evident in sectors like automotive and aerospace, where the demand for innovative materials is on the rise. Data indicates that R&D spending in the materials sector is expected to increase by approximately 8% annually, which could lead to breakthroughs in para-aramid fiber applications. As manufacturers strive to differentiate their products, the emphasis on R&D is likely to play a crucial role in shaping the future landscape of the para-aramid fiber market.

Regulatory Support for High-Performance Materials

The Para-Aramid Fiber Market is also influenced by regulatory support for high-performance materials. Governments are increasingly recognizing the importance of advanced materials in enhancing safety and performance across various sectors. This regulatory backing is likely to encourage the adoption of para-aramid fibers in applications ranging from automotive to construction. Recent legislative measures aimed at promoting the use of lightweight and durable materials suggest a favorable environment for the para-aramid fiber market. As regulations evolve to support innovation and sustainability, the demand for para-aramid fibers is expected to rise, thereby reinforcing their position in the market.