Packaging Size

Market Size Snapshot

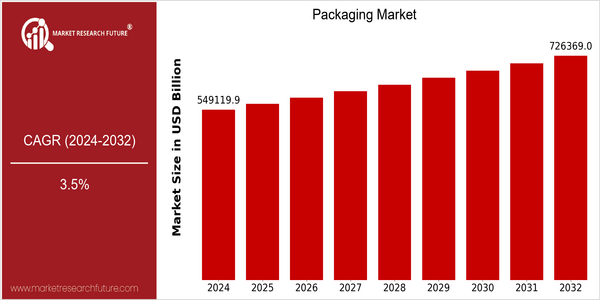

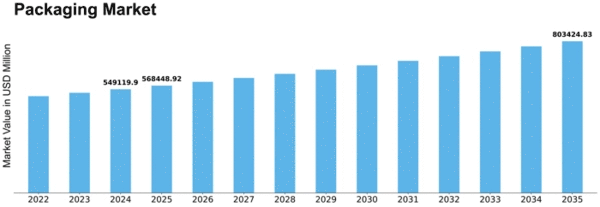

| Year | Value |

|---|---|

| 2024 | USD 549119.9 Billion |

| 2032 | USD 726369.0 Billion |

| CAGR (2024-2032) | 3.5 % |

Note – Market size depicts the revenue generated over the financial year

The world market for paper is undergoing a rapid change, with a current market size of 549,119.9 billion U.S. dollars in 2024, and a projected size of 726,369.0 billion U.S. dollars by 2032. This represents an annual growth rate of 3.5% during the forecast period. This steady growth can be attributed to the increasing demand for sustainable packaging solutions, the development of packaging technology, and the rapid development of e-commerce, which requires the use of new materials and methods to protect the products and improve the shopping experience. Smart packaging, such as the use of QR codes and NFC, is expected to increase product traceability and improve the shopping experience, driving the market to grow. The industry is actively investing in research and development to enhance its product offerings. The strategic cooperation of paper companies to develop eco-friendly materials and the investment of automation equipment have also shown the industry's commitment to meeting changing customer preferences and regulatory requirements. These developments will continue to shape the future of the industry.

Regional Market Size

Regional Deep Dive

The packaging market is experiencing dynamic growth in several regions, driven by an increasing demand for sustainable and new packaging solutions. North America is characterised by the use of eco-friendly materials and advanced technology, while in Europe the trend is towards a circular economy. In the Asia-Pacific region, rapid urbanisation and rising incomes are driving growth, while in the Middle East and Africa, development is being driven by the expansion of the retail sector and improved infrastructure. In Latin America, on the other hand, the trend is towards more efficient and sustainable packaging in response to changing consumer demands.

Europe

- The European Union's Green Deal is driving the packaging industry towards sustainability, with initiatives aimed at reducing plastic waste and promoting recyclable materials, impacting companies like Unilever and Nestlé.

- Innovations in smart packaging technologies, such as those developed by companies like Tetra Pak, are enhancing product safety and traceability, catering to the growing consumer demand for transparency in food packaging.

Asia Pacific

- Rapid urbanization in countries like China and India is leading to increased demand for packaged goods, prompting companies such as Amcor and Sealed Air to expand their operations in the region.

- The rise of health-conscious consumers is driving demand for packaging that preserves freshness and extends shelf life, with innovations in vacuum packaging and modified atmosphere packaging gaining traction.

Latin America

- The increasing focus on sustainability is prompting companies in Brazil and Mexico to invest in eco-friendly packaging solutions, with firms like Grupo Petrópolis leading the charge in adopting biodegradable materials.

- Consumer preferences are shifting towards convenience and portability, driving demand for flexible packaging solutions, which are being innovated by local companies to cater to this trend.

North America

- The rise of e-commerce has significantly influenced packaging design and materials, with companies like Amazon investing in innovative packaging solutions to reduce waste and enhance customer experience.

- Regulatory changes, such as California's SB 54, which mandates a reduction in single-use plastics, are pushing companies to adopt more sustainable packaging practices, leading to increased demand for biodegradable and recyclable materials.

Middle East And Africa

- The growth of the retail sector in the UAE and Saudi Arabia is leading to increased demand for packaging solutions, with companies like Al Bayader International investing in advanced packaging technologies.

- Government initiatives aimed at reducing plastic waste, such as the UAE's National Plastic Action Plan, are encouraging businesses to adopt sustainable packaging practices, impacting market dynamics significantly.

Did You Know?

“Approximately 30% of all packaging produced globally is made from plastic, and a significant portion of this is single-use, contributing to environmental concerns.” — World Economic Forum

Segmental Market Size

A large part of the overall packaging market is constituted by the sustainable packaging sector, which is growing rapidly, driven by the growing demand for eco-friendly solutions. The growing demand is being driven by the growing awareness of consumers and the tightening of regulations in order to reduce plastic waste. Leading companies such as Unilever and Coca-Cola are committing themselves to sustainable packaging initiatives, thereby highlighting the importance of the sector for their strategic plans. The sustainable packaging sector is currently in its maturity phase, and is characterized by the widespread use of biodegradable materials and recyclability across a wide range of industries. Food and beverage packaging is the most important application. Brands are increasingly opting for bio-based materials in order to meet consumer preferences. The growth of the sustainable packaging sector is being accelerated by the macro-economic trends of the reduction of plastic waste and the commitment of the leading companies to sustainable packaging. The evolution of the sector is being shaped by the development of new materials such as bioplastics and the introduction of new methods of recycling.

Future Outlook

The market for packaging is set to grow considerably from 2024 to 2032. The projected market value will increase from approximately US$549 billion to US$726 billion, with a CAGR of 3.6%. This growth is driven by the growing demand for sustainable packaging solutions. The growing demand for sustainable packaging is driven by increasing public awareness of the environment and by government regulations. Accordingly, companies are striving to achieve the goals of sustainability. This will result in an increase in the use of biodegradable and recyclable materials, which could account for more than 30% of the market by 2032. Also playing a crucial role in the future of the packaging industry is the development of new technology. Smart packaging, for example, which is based on IoT technology to increase the tracking and consumer engagement of the package, is set to gain popularity. Also, the integration of automation and AI into the packaging process will increase efficiency and reduce costs, which will also contribute to the growth of the market. Also, new trends, such as the development of e-commerce, will respond to the preferences of consumers and will therefore ensure that the packaging market remains flexible and responsive to the market. In short, the packaging industry has a bright future ahead of it, and the path towards sustainable and technologically advanced solutions that are in line with the global trends is clear.

Leave a Comment