North America : Health-Conscious Consumer Base

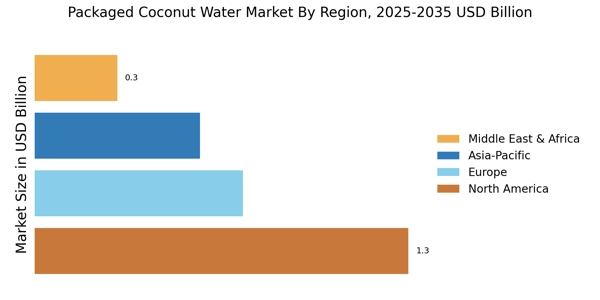

The North American packaged coconut water market is driven by a growing health-conscious consumer base, with increasing awareness of the benefits of coconut water, such as hydration and electrolytes. The region holds the largest market share at approximately 45%, with the U.S. leading the charge. Regulatory support for health claims on beverages further fuels demand, as consumers seek natural alternatives to sugary drinks. In the competitive landscape, the U.S. is home to key players like Vita Coco, Zico, and Harmless Harvest, which dominate the market. The presence of these brands, along with innovative marketing strategies and product diversification, enhances market growth. The trend towards organic and sustainably sourced products is also gaining traction, appealing to environmentally conscious consumers. The market is expected to continue expanding as more brands enter the space, catering to diverse consumer preferences.

Europe : Emerging Market Potential

Europe's packaged coconut water market is emerging, driven by increasing consumer interest in health and wellness products. The region holds a market share of around 25%, with the UK and Germany being the largest markets. Regulatory frameworks promoting natural beverages and health claims are pivotal in shaping consumer preferences, encouraging a shift from traditional soft drinks to healthier options. Leading countries like the UK and Germany are witnessing a surge in coconut water consumption, supported by the presence of brands such as Vita Coco and local entrants. The competitive landscape is characterized by a mix of established players and new entrants, focusing on organic and flavored variants to attract diverse consumer segments. As awareness of the health benefits of coconut water grows, the market is poised for significant expansion in the coming years.

Asia-Pacific : Dominance in Production and Consumption

The Asia-Pacific region is a powerhouse in the packaged coconut water market, driven by high production levels and increasing domestic consumption. This region holds a market share of approximately 20%, with countries like the Philippines and Thailand leading in both production and export, while emerging consumption trends in the India packaged coconut water market are further accelerating regional growth. The growing trend of health and wellness, coupled with rising disposable incomes, is propelling demand for coconut water as a natural beverage alternative.

In the competitive landscape, the Philippines is home to key players like Coconut Grove, which leverage local production to meet both domestic and international demand. The market is characterized by a mix of local brands and international entrants, focusing on sustainability and organic certifications. As consumer preferences shift towards healthier options, markets such as the Australia packaged coconut water market and the India packaged coconut water market are expected to witness steady growth, driven by innovation and product diversification.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa region is witnessing rapid growth in the packaged coconut water market, driven by increasing health awareness and a shift towards natural beverages. The market share is currently around 10%, with countries like South Africa and the UAE leading the charge. Regulatory support for health claims and the promotion of natural products are key drivers of this growth, as consumers seek healthier alternatives to sugary drinks. In this region, the competitive landscape is evolving, with both local and international brands entering the market. Key players are focusing on product innovation and marketing strategies to capture the growing consumer base. The presence of coconut water in retail outlets and online platforms is increasing, making it more accessible to consumers. As awareness of the benefits of coconut water continues to rise, the market is expected to expand significantly in the coming years.