Top Industry Leaders in the Oxygen-Free Copper Market

The oxygen-free copper (OFC) market, valued at over USD 18 billion in 2021, is a dynamic space witnessing steady growth driven by its exceptional conductivity, strength, and corrosion resistance. This makes it the material of choice for critical applications in electronics, aerospace, power generation, and healthcare. However, navigating this competitive landscape requires understanding the strategies adopted by key players, factors influencing market share, and recent industry developments.

The oxygen-free copper (OFC) market, valued at over USD 18 billion in 2021, is a dynamic space witnessing steady growth driven by its exceptional conductivity, strength, and corrosion resistance. This makes it the material of choice for critical applications in electronics, aerospace, power generation, and healthcare. However, navigating this competitive landscape requires understanding the strategies adopted by key players, factors influencing market share, and recent industry developments.

Strategies Adopted by Leading Players:

-

Product Differentiation: Leading players like KME Mansfeld and Hussey Copper are diversifying their product offerings by developing specialized OFC grades for specific applications. For instance, KME offers high-strength OFC variants for aerospace applications. -

Vertical Integration: Backward integration into copper refining and upstream production is another key strategy. Companies like Umicore and Aurubis are securing raw material supply and gaining cost advantages through vertical integration. -

Technological Innovation: Investing in research and development of new production methods and applications is crucial for staying ahead. Companies like JX Nippon Mining & Metals are exploring innovative casting and extrusion techniques to improve OFC properties and reduce production costs. -

Geographical Expansion: Entering emerging markets with high growth potential, particularly in Asia-Pacific, is a common strategy. Companies like LS Mtron are establishing production facilities and distribution networks in these regions. -

Sustainability Focus: With increasing environmental concerns, adopting sustainable practices like energy-efficient production processes and recycling used OFC is becoming a differentiator. Companies like Aurubis are investing heavily in green technologies to reduce their environmental footprint.

Factors Influencing Market Share:

-

Price Fluctuations: The price of copper is a significant determinant of OFC market share. Stable prices favor established players with long-term contracts and efficient procurement strategies. -

Product Quality and Consistency: Maintaining high purity and consistent quality is crucial for gaining customer trust and market share. Leading players invest heavily in quality control and assurance measures. -

Technological Advancements: Companies adopting cutting-edge technologies to improve OFC properties and production efficiency gain an edge over competitors. -

Regional Demand Dynamics: The demand for OFC varies across different regions based on economic growth and specific industry trends. Companies with a strong presence in high-growth markets like China and India benefit from increased demand. -

Government Regulations and Policies: Government policies on environmental regulations and infrastructure development can impact the demand for OFC in specific sectors. Companies that adapt quickly to changing regulations can gain a competitive advantage.

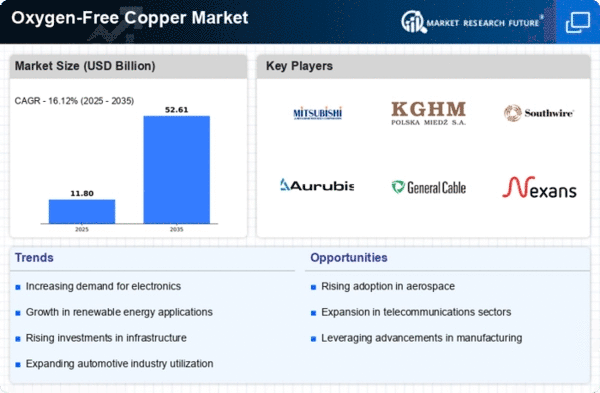

Key Players

- Hitachi Metals Neomaterials Ltd.

- Mitsubishi Materials Corporation

- Aviva Metals

- Sam Dong

- Copper Braid Products

- Farmer's Copper Ltd.

- Heyco Metals Inc.

- Haviland Enterprises Inc.

- Millard Wire & Specialty Strip Co.

- Hussey Copper Ltd.

Recent Developments:

-

September 2023: KME Mansfeld introduces a new high-purity OFC grade with improved electrical conductivity for next-generation semiconductors. -

October 2023: LS Mtron acquires a major OFC wire and cable manufacturer in Vietnam, strengthening its presence in the Southeast Asian market. -

November 2023: The Chinese government announces new environmental regulations on copper refining, impacting the production costs of some OFC manufacturers. -

December 2023: The European Union approves a €2 billion initiative to invest in research and development of sustainable OFC production technologies.