Government Initiatives and Regulations

The Outdoor Lighting Market is being shaped by various government initiatives and regulations aimed at promoting energy efficiency and sustainability. Many governments are implementing policies that encourage the adoption of energy-efficient lighting solutions, including financial incentives and rebates for consumers and businesses. Additionally, regulations regarding outdoor lighting standards are becoming more stringent, pushing stakeholders to adopt advanced technologies. For example, some regions have mandated the use of LED lighting in public spaces to reduce energy consumption. These government actions are likely to foster growth in the Outdoor Lighting Market, as they create a favorable environment for the adoption of innovative lighting solutions.

Rising Awareness of Safety and Security

The Outdoor Lighting Market is also being driven by an increasing awareness of safety and security concerns among consumers. Well-lit outdoor spaces are essential for deterring crime and enhancing the sense of safety in residential and commercial areas. As communities prioritize safety, the demand for effective outdoor lighting solutions is likely to rise. Studies have shown that improved lighting can reduce crime rates by up to 30% in certain areas. Consequently, this heightened focus on safety is expected to stimulate growth in the Outdoor Lighting Market, as both public and private sectors invest in better lighting solutions to create safer environments.

Growing Demand for Energy-Efficient Solutions

The Outdoor Lighting Market is witnessing a surge in demand for energy-efficient lighting solutions. As environmental concerns continue to rise, consumers and businesses alike are increasingly prioritizing sustainability. Energy-efficient outdoor lighting options, such as solar-powered lights and LED fixtures, are becoming more popular due to their lower carbon footprint and reduced energy costs. According to recent data, the energy-efficient lighting segment is projected to grow at a compound annual growth rate of over 10% in the coming years. This trend reflects a broader shift towards sustainable practices, which is likely to further propel the Outdoor Lighting Market as stakeholders seek to minimize their environmental impact while maintaining effective lighting solutions.

Technological Advancements in Outdoor Lighting

The Outdoor Lighting Market is experiencing a notable transformation due to rapid technological advancements. Innovations such as LED technology and smart lighting systems are becoming increasingly prevalent. These technologies not only enhance energy efficiency but also offer improved longevity and reduced maintenance costs. For instance, the adoption of LED lighting has been reported to reduce energy consumption by up to 75% compared to traditional lighting solutions. Furthermore, smart lighting systems, which can be controlled remotely and programmed for various settings, are gaining traction among consumers. This shift towards more sophisticated lighting solutions is likely to drive growth in the Outdoor Lighting Market, as consumers seek to integrate these technologies into their homes and public spaces.

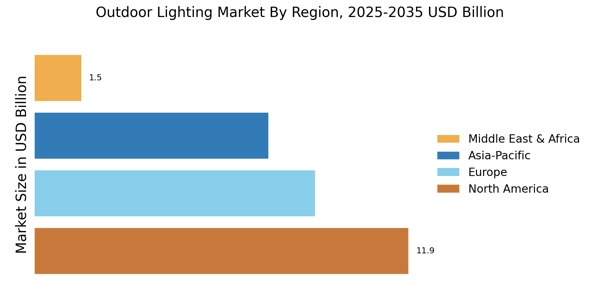

Increased Focus on Urbanization and Infrastructure Development

The Outdoor Lighting Market is significantly influenced by the ongoing trends in urbanization and infrastructure development. As cities expand and new urban areas emerge, the need for effective outdoor lighting solutions becomes paramount. Enhanced lighting is essential for public safety, aesthetic appeal, and functionality in urban environments. Recent statistics indicate that urban areas are expected to grow by approximately 2.5 billion people by 2050, necessitating substantial investments in infrastructure, including outdoor lighting. This growth presents a substantial opportunity for the Outdoor Lighting Market, as municipalities and developers seek to implement advanced lighting solutions that cater to the needs of expanding populations.