Market Growth Projections

The Global Osteoarthritis Market Industry is poised for substantial growth, with projections indicating a market size of 5.12 USD Billion in 2024 and an anticipated increase to 13.4 USD Billion by 2035. This growth trajectory suggests a robust demand for osteoarthritis treatments and management solutions. The compound annual growth rate (CAGR) of 9.12% from 2025 to 2035 reflects the increasing recognition of osteoarthritis as a significant public health issue. As stakeholders in the healthcare sector respond to this demand, the market is likely to witness innovations and enhancements in treatment options, further solidifying its growth potential.

Growing Awareness and Education

The rising awareness and education surrounding osteoarthritis are crucial drivers of the Global Osteoarthritis Market Industry. Public health campaigns and educational initiatives are increasingly informing individuals about the disease, its risk factors, and management strategies. This heightened awareness encourages early diagnosis and treatment, which can lead to better health outcomes. Moreover, healthcare professionals are receiving enhanced training on osteoarthritis management, further promoting effective treatment options. As patients become more informed about their condition, they are more likely to seek medical advice and treatment, thereby driving market growth and fostering a proactive approach to managing osteoarthritis.

Increased Healthcare Expenditure

Growing healthcare expenditure across various regions is likely to bolster the Global Osteoarthritis Market Industry. As countries invest more in healthcare infrastructure and services, the availability and accessibility of osteoarthritis treatments improve. For instance, nations with higher healthcare budgets are more capable of funding advanced therapies and technologies. This trend is particularly evident in developed economies, where healthcare spending is projected to rise significantly in the coming years. The increased allocation of resources towards chronic disease management, including osteoarthritis, suggests a favorable environment for market expansion, potentially leading to a compound annual growth rate (CAGR) of 9.12% from 2025 to 2035.

Advancements in Treatment Options

Innovations in treatment modalities for osteoarthritis are propelling the Global Osteoarthritis Market Industry forward. Recent developments in pharmaceuticals, biologics, and regenerative medicine offer new avenues for managing symptoms and improving patient outcomes. For instance, the introduction of disease-modifying osteoarthritis drugs (DMOADs) aims to slow disease progression, which could alter the treatment landscape. Furthermore, minimally invasive surgical techniques are gaining traction, providing patients with effective alternatives to traditional surgery. These advancements not only enhance the quality of life for patients but also contribute to market growth, as healthcare providers seek to adopt the latest evidence-based practices.

Rising Prevalence of Osteoarthritis

The increasing prevalence of osteoarthritis globally is a primary driver of the Global Osteoarthritis Market Industry. As populations age, the incidence of osteoarthritis is expected to rise significantly. In 2024, the market is projected to reach 5.12 USD Billion, reflecting the growing need for effective treatments and management strategies. The World Health Organization indicates that osteoarthritis affects approximately 10% of the global population over 60 years, highlighting the urgency for innovative solutions. This trend is likely to continue, with projections suggesting that by 2035, the market could expand to 13.4 USD Billion, driven by the aging demographic and the associated healthcare demands.

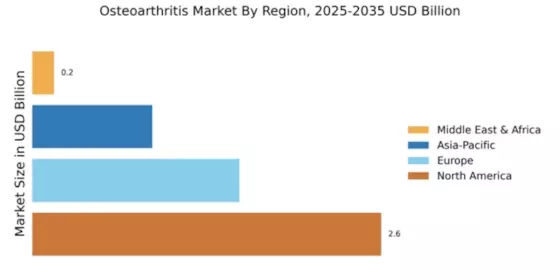

Emerging Markets and Demographic Shifts

Emerging markets are becoming increasingly significant in the Global Osteoarthritis Market Industry due to demographic shifts and economic development. Countries in Asia-Pacific and Latin America are witnessing rapid urbanization and an increase in life expectancy, leading to a higher prevalence of osteoarthritis. As these regions develop economically, there is a growing demand for healthcare services and treatments. This trend is expected to create new opportunities for market players, as they seek to cater to the unique needs of these populations. The expansion into emerging markets could play a pivotal role in achieving the projected market growth, with a CAGR of 9.12% anticipated from 2025 to 2035.