Market Trends

Key Emerging Trends in the Orthopedic Prosthetics Market

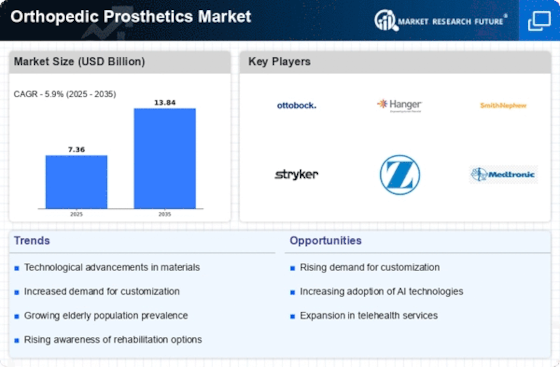

The orthopedic prosthetics industry is as of now encountering huge movements because of innovative progressions, the maturing of populaces, and an elevated spotlight on usefulness and comfort. The coordination of state-of-the-art materials and advancements, including carbon fibre and titanium, into prosthetics is working on their usefulness and ease of use. This peculiarity connotes a shift towards imaginative setups that copy natural movement and further develop the general prosperity of people with removals. Orthopedic prosthetics is seeing an expansion in the acknowledgment of 3D-printed prosthetics because of their ability to manufacture tweaked prostheses, in this way improving solace, arrangement, and the satisfaction of individual requirements, with an accentuation on individualized care. Bionic and astute prosthetics, which offer normal development control and versatility and overcome any issues among fake and regular appendage usefulness, are multiplying available. Because of expanded joint effort between prosthetic makers, medical services suppliers, and exploration establishments that integrate state of the art advances, the orthopedic prosthetics market is going through a time of development. The market is presently seeing the effect of advancements in connection point and attachment innovation, which mean to enhance the association between the prosthetic gadget and the client's leftover appendage, as well as increment solace and decrease grating. The ongoing business sector pattern is towards an emphasis on client focused plan and patient support in prosthetic turn of events, with tragically handicapped people's points of view and encounters being coordinated to ensure that gadgets take care of an extensive variety of client needs. Medical services strategies and repayment systems are teaming up to work on the moderateness and accessibility of orthopedic prosthetics, consequently cultivating equivalent open doors and inclusivity for people who have lost an appendage. Exoskeleton innovation is progressively being embraced in the field of orthopedics prosthetics. By offering outer help and improving versatility for people with lower appendage handicaps, it widens the expected uses of wearable advanced mechanics. The execution of tangible criticism procedures in orthopedics prosthetics improves the client experience through the reclamation of proprioception and discernment, consequently upgrading usefulness and fulfilment. The market is progressively perceiving the mental and close to home implications of limbs removal, in this way highlighting the requirement for far reaching prosthetic consideration that considers the double elements of physical and profound recovery. Natural supportability is fundamentally important in the market, which utilizes eco-accommodating textures and assembling cycles to decrease the natural effect of prosthetic gadgets.

Leave a Comment