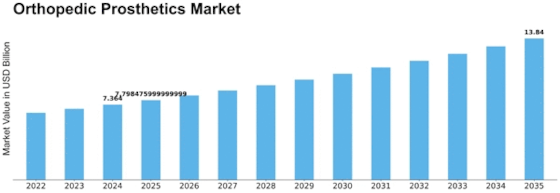

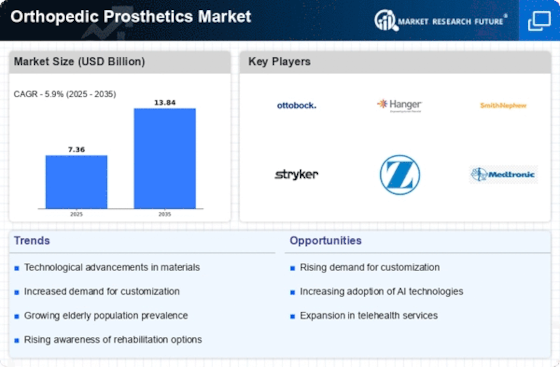

Orthopedic Prosthetics Size

Orthopedic Prosthetics Market Growth Projections and Opportunities

Expanding paces of outer muscle issues and horrible wounds, as well as a maturing populace and progressively dynamic ways of life, are driving the orthopedic prosthetics market. Subsequently, there is a developing interest for imaginative prosthetic arrangements. The market for orthopedic prosthetics is influenced by mechanical headways that upgrade portability, solace, and execution for people with appendage misfortune. Headways in materials, fabricating cycles, and plan, for example, three-layered printing utilizing clever advancements, all add to the multiplication of exceptionally practical instruments. The market elements of clinical gadgets, including prosthetics, are fundamentally impacted by the administrative climate. Adherence to thorough administrative principles ensures the wellbeing, viability, and nature of an item, which thusly influences its endorsement, commercialization, and clinical reception. This encourages certainty among medical services suppliers and patients. In various districts, monetary variables, medical services foundation, medical care availability, repayment guidelines, and financial circumstances impact the execution of orthopedics prosthetics, requiring that market members adjust their items to address explicit difficulties. Ceaseless innovative work drives the orthopedics prosthetics market, with organizations underlining biomechanical usefulness, solace, and solidness with an end goal to cultivate advancement and extend abilities. Market development in neurocontrolled prosthetics, interface upgrades, and recovery rehearses is moved by worldwide joint efforts among prosthetic makers, research foundations, and medical care associations. These associations address the necessities of patients and recovery experts. The market for orthopedic prosthetics focuses on tasteful customization and ease of use with an end goal to upgrade the general insight for people with prosthetic members. The reception of orthopedic prosthetics is significantly affected by open mindfulness and instruction drives, considering that information in regard to prosthetic inclinations and advancements builds the requirement for upgraded usefulness and normal stride. Social and mental variables, as well as emotional well-being issues, are acquiring significance as impacts in the industry. Progressively, it is perceived that the mental and profound impacts of appendage removal should likewise be thought of, notwithstanding the actual effects. There is a rising accentuation on prosthetic gadgets that reestablish usefulness as well as improve the client's feeling of prosperity and self-perception.

Leave a Comment