Growing Awareness of Oral Health

The Orthodontic Supplies Market is benefiting from a heightened awareness of oral health among the general population. Educational campaigns and increased access to information have led to a greater understanding of the importance of orthodontic treatment in maintaining overall dental health. This awareness is particularly evident among parents who are more inclined to seek orthodontic evaluations for their children at an earlier age. As a result, the demand for orthodontic supplies is expected to rise, with an increasing number of patients seeking preventive and corrective treatments. This trend is further supported by statistics indicating that nearly 70% of adolescents require some form of orthodontic intervention, thereby creating a substantial market opportunity for suppliers.

Expansion of Orthodontic Practices

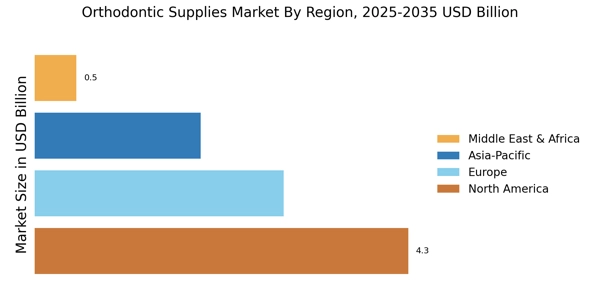

The Orthodontic Supplies Market is witnessing an expansion of orthodontic practices, particularly in emerging markets where access to orthodontic care is improving. As more practitioners enter the field, the demand for orthodontic supplies is likely to increase correspondingly. This expansion is fueled by a growing middle class that is increasingly willing to invest in orthodontic treatments for themselves and their children. Additionally, the establishment of new clinics and the expansion of existing ones are contributing to a more competitive landscape, which may drive innovation and lower prices in the market. This trend suggests a promising outlook for suppliers as they cater to a larger and more diverse customer base.

Increased Focus on Preventive Care

The Orthodontic Supplies Market is experiencing a shift towards preventive care, with an emphasis on early intervention strategies. This trend is driven by a growing recognition of the long-term benefits of addressing orthodontic issues at an early age. As a result, orthodontic suppliers are increasingly developing products that facilitate preventive care, such as space maintainers and interceptive appliances. The market is likely to see a rise in demand for these supplies as parents and healthcare providers prioritize early assessments and treatments. This proactive approach not only enhances patient outcomes but also contributes to the overall growth of the orthodontic supplies market, as more individuals seek to prevent complex orthodontic issues before they arise.

Rising Demand for Aesthetic Orthodontics

The Orthodontic Supplies Market is experiencing a notable increase in demand for aesthetic orthodontic solutions, such as clear aligners and ceramic braces. This trend is largely driven by the growing preference among patients for discreet treatment options that do not compromise their appearance. According to recent data, the market for clear aligners alone is projected to reach approximately 4 billion USD by 2026, indicating a robust growth trajectory. As more adults seek orthodontic treatment, the industry is adapting to meet these aesthetic preferences, thereby expanding its product offerings. This shift not only enhances patient satisfaction but also encourages orthodontic practices to invest in innovative supplies that cater to this evolving demand.

Technological Innovations in Orthodontics

Technological advancements are significantly shaping the Orthodontic Supplies Market, with innovations such as 3D printing, digital scanning, and artificial intelligence becoming increasingly prevalent. These technologies streamline the orthodontic process, allowing for more precise treatment planning and improved patient outcomes. For instance, 3D printing enables the rapid production of custom aligners and orthodontic appliances, reducing lead times and costs. The integration of digital tools enhances the efficiency of orthodontic practices, which can lead to increased patient throughput. As these technologies continue to evolve, they are likely to drive further growth in the market, as practitioners seek to adopt the latest tools to enhance their service offerings.