January 2024 – In late December 2023, PT Pertamina (Persero) established a production kit worth IDR 100 million to the winner of the micro, medium, and small enterprises (MSMEs) development competition by Pertamina, namely the Pertapreneur Aggregator 2023. CV Bunga Palm, the winner of this Pertapreneur competition, will use this manufacturing production equipment for a healthy kitchen program, profiting hundreds of sap tappers to improve the quality of palm sugar, making it ideal for export. Pertapreneur Aggregator is Pertamina's development program for MSMEs to be Collaborative MSMEs or fostered MSMEs that can nurture other MSMEs by developing collective networks among neighboring MSMEs.

The chain program focuses on collectively advancing MSMEs, strengthening entrepreneurs to be self-sufficient and competitive, and, at last, boosting local and regional economies.

March 2023- The Kampong Speu palm sugar market has extended its possibilities thanks to the escalating demand from domestic and international markets. However, several palm tree climbers are reaching old age, causing a lesser production capacity that cannot meet market demands. Vy Veasna of the Kampong Speu Palm Sugar Promotion Association (KSPA) conveyed worries over the lowering number of members and the influence on production caused by the younger generation's disinterest in pursuing a career climbing palm trees.

He said that the present market demand is not a test for the KSPA, but the real challenge is the irregular number of farmers. Veasna stated that last year, the market demand for powdered palm sugar was nearly 150 tonnes, but the community could offer only 70 tonnes. This year, more than 100 tonnes are required, but so far, the community has only collected 30 tonnes of sugar with only three months left for production

Recent Trends

Consumers are increasingly concerned about the environmental and social impact of their purchases. This translates to a demand for organic palm sugar produced with sustainable practices and fair trade certifications. Companies like BigTree Farms are known to focus on establishing strong relationships with Southeast Asian farmers, ensuring a stable and ethical supply chain

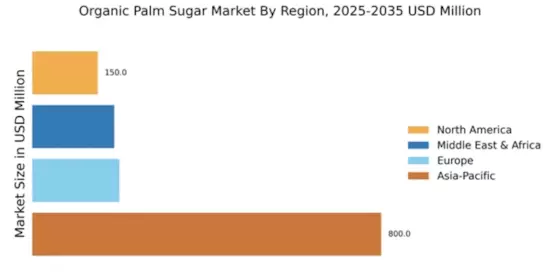

Regional Market Summary Global Organic Palm Sugar Market Share (%), by Region, 2020

Source: Secondary Source and MRFR Analysis Asia-Pacific is expected to dominate the organic palm sugar market during the forecast period. Palm sugars are traditionally been used in the region owing to high palm and coconut cultivation in the region. However, North America is anticipated to register the highest CAGR due to the changing lifestyle of people and growing demand for organic products in the region.

Organic Palm Sugar Market, by Form

Block

Granule

Liquid

Organic Palm Sugar Market, by Packaging type

Bottles & Jars

Pouches

Organic Palm Sugar Market, by Distribution Channel

Store-Based

Hypermarkets & Supermarkets

Convenience Stores

Others

Non-Store-Based

Organic Palm Sugar Market, by Region

North America

US

Canada

Mexico

Europe

Germany

France

Italy

Spain

UK

Rest of Europe

Asia-Pacific

Japan

China

India

Australia and New Zealand

Rest of Asia-Pacific

Rest of the World (RoW)

South America

Middle East

Africa

Intended Audience

Organic Palm Sugar Market manufacturers

Dealers and distributors

Raw material suppliers and distributors

Traders, exporters, and importers