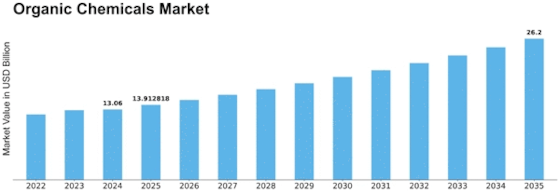

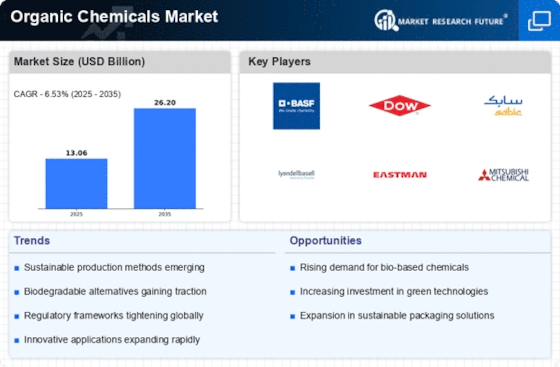

Organic Chemicals Size

Organic Chemicals Market Growth Projections and Opportunities

A multitude of factors influencing production, demand, and market dynamics form the organic chemicals industry. In order to traverse the complicated terrain of the organic chemicals sector and make educated decisions, industry participants must have a thorough understanding of key market aspects. Feedstock Price and Availability: The market for organic chemicals is heavily influenced by the cost and accessibility of feedstock, which includes natural gas and crude oil. The production costs of organic chemical producers can be greatly impacted by fluctuations in feedstock prices, which can also have an influence on their overall competitiveness. Situation of the World Economy: The state of the world economy has a direct impact on the market for organic chemicals. The cyclical character of the industry is reflected in the influence that economic growth and stability have on the demand for organic chemicals across a range of industries, including consumer products, manufacturing, and construction. Regulatory Environment: The market for organic compounds is significantly impacted by strict laws and environmental initiatives. Regulation adherence has an impact on industry-wide sustainability practices, product compositions, and production methods. Technological Developments: Innovation in the procedures used to produce organic chemicals is fueled by technological developments. New and specialized organic chemical products are developed, efficiency is increased, and environmental impact is decreased with the help of improved technology. Transition to Sustainable Methods: In the world of organic chemicals, sustainable techniques are becoming more and more popular. Businesses that focus on environmentally friendly manufacturing techniques, lower emissions, and embrace green chemistry concepts will be better positioned to satisfy changing customer and regulatory demands. need from End-User sectors: The pharmaceutical, agricultural, textile, and automotive sectors are among those with a strong correlation with the need for organic chemicals. The total demand for organic compounds is greatly influenced by the economic activity and trends within various industries. customer tastes and Market Trends: The kinds of organic compounds that are in demand are influenced by shifting customer tastes and market trends. For instance, growing consumer awareness and environmental trends are driving the need for eco-friendly goods and bio-based chemicals. Global Trade Dynamics: Trade agreements and tariffs have an impact on the market for organic chemicals. Trade policy changes may have an impact on the competitiveness of imports and exports of organic chemicals, which may have an effect on price and market dynamics.

Leave a Comment