Market Analysis

In-depth Analysis of Organic Chemicals Market Industry Landscape

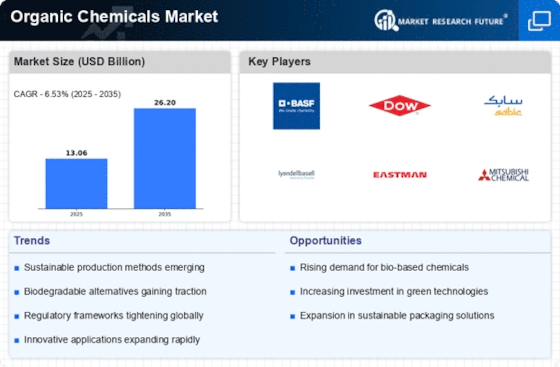

Numerous factors that combined affect price, demand, production, and general industry trends drive the dynamics of the organic chemicals market. It is imperative that industry players comprehend these market dynamics in order to successfully traverse obstacles, seize opportunities, and adapt to the changing environment of the organic chemicals sector. Feedstock Price Volatility: The market for organic chemicals is greatly impacted by changes in the cost of essential feedstocks, such as natural gas and crude oil. Price volatility has the potential to impact manufacturing costs, which in turn can impact profit margins and the industry's overall competitiveness. Situation of the World Economy: The state of the world economy is directly related to the dynamics of the market. The market is intrinsically cyclical due to the impact of economic development, industrial operations, and consumer spending patterns on the demand for organic chemicals across different end-user sectors. Regulatory Environment: The market dynamics for organic compounds are significantly impacted by strict regulations and changing environmental policies. Industry manufacturing methods, product formulas, and sustainability strategies are all impacted by regulatory requirements compliance. technical Developments: The dynamics of the market are significantly shaped by ongoing technical developments. Catalysts, sustainable technologies, and process innovations are what propel efficiency gains, product diversity, and industry competitiveness in the organic chemicals industry. Transition to Sustainable Practices: The industry's move toward sustainable practices is a noteworthy dynamic. Businesses are responding to changing customer tastes and governmental pressure by implementing eco-friendly manufacturing methods, cutting emissions, and embracing green chemistry concepts. End-User Industry Demand: There is an innate relationship between market dynamics and end-user industry demand. Based on economic activity and market trends, industries including medicines, agriculture, textiles, and automotive have a substantial impact on the total demand for organic chemicals. Consumer Preferences and Trends: The dynamics of the market are significantly influenced by shifting consumer preferences and market trends. Growing consumer awareness and emphasis on environmental responsibility are driving demand for sustainable solutions, bio-based chemicals, and eco-friendly products. The market for organic chemicals is experiencing rapid changes due to a number of developments that are reflecting shifting customer tastes, improvements in technology, and dynamics within the worldwide industry. Industry participants must comprehend these market trends in order to remain adaptable, spot development prospects, and handle new obstacles with skill. Bio-based Chemicals' Ascent: The growing popularity of bio-based chemicals is a notable trend in the organic chemicals market. Growing consumer demand for eco-friendly alternatives and worries about the environment are pushing the sector toward sustainable and renewable feedstocks.

Leave a Comment