Orbital Spaceflight Size

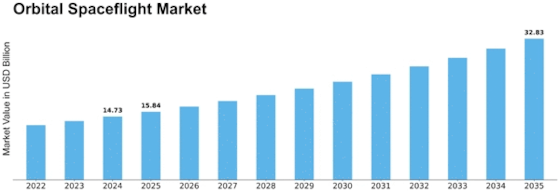

Orbital Spaceflight Market Growth Projections and Opportunities

Inside the globe of Orbital Spaceflight Market, various factors contribute to the environment, which defines the growth rate, competition between flighers, and direction of a space market. The central market dynamics fact is that more and more people and companies are involved in the investment in space missions or the deploying of the satellites. From global or national governments to international private companies and multilateral schemes providing launch capabilities, there is a considerable increase in the demand for satellites deployment services with the purpose of communications, Earth observarion, and scientific investigations. The expanding influence on satellite constellations as well as the vitality in the appropriate launch service makes it to the market's dynamic.

Technological progression holds a very important place when it concerns with the Orbital Spaceflight Market. The endless innovations ranging from the vehicle launch design to the propulsion systems and satellites are the factor that lead to better efficiency, low cost and capacity to carry more satellite payloads. The space related technologies are ever-changing and this paves the way for businesses in the field to emerge and thrive on the backdrop of developing advanced solutions that add to the beauty, practicality and the expansibility of orbital spaceflight.

Other players such as private space companies introduce new dynamics to market frameworks. Space corporations as SpaceX, Blue Origin etc, cleared the situation in traditional rockets launching by their reusable rockets technologies introduction, reduction of the costs, and increasing frequency of the launches. The transition in the space industry toward commercial space flights practices is an impetus for competetiveness, innovation and de facto being of others players – who should rethink their strategies in order to hold on the ground amid the novel market conditions.

The Earth-specific geopolitics also plays a role in influencing the characteristics of this market. The space domain is turning to being a strategic asset which is seen as very important by many countries as they are increasing their space capabilities in terms of security and benefits that they can derive. In which respects the international political roadmap for orbital spaceflight services decides the demand of different countries and nations for such services as many of them undergo the process of acquisition and placement of their satellite constellations, as well as Earth observation assets, and the national security payloads.

Regulator schemes as well determine how the orbital spaceflight market will be operated. Governments and globally applicable bodies draw up standards and licensing regulations. These are aimed at preserving the safety of space, and preventing it being misused. Conversely, A market players must follow to the regulations leads to the design quality, testing, and operation of the launch vehicles to be subjected. Changes in regulatory dynamics might as well influence the notion of market dynamics by making the playing field to favor innovation or by posing foreclosure threats to market entry.

Investments in the term of public and private sectors can influence the sector or the market of Orbital Spaceflight. The space agencies of world governments tend to have their budgets rooted in the launch& of satellites and missions in the exploration of space whereas the commercial space companies experience great growth due to the private investments of investors. A trend of economic fluctuation, changes in budget, and financial health of stakeholders like shareholders, consumers, and partners play a significant role in stabilising, or maybe even destabilising, the market conditions and its potential.

Leave a Comment