Escalating Defense Budgets

In response to rising security threats, many nations are increasing their defense budgets, which directly impacts the Rockets and Missiles Market Industry. Countries are prioritizing the modernization of their military capabilities, leading to substantial investments in missile defense systems and offensive capabilities. For example, the United States has allocated over $20 billion for missile defense initiatives in its recent budget, reflecting a broader trend among allied nations. This financial commitment is expected to stimulate demand for advanced missile systems, thereby propelling market growth. As nations seek to enhance their deterrence strategies, the focus on developing next-generation rockets and missiles is likely to intensify.

International Arms Treaties and Regulations

The Rockets and Missiles Market Industry is affected by international arms treaties and regulations that govern the development and proliferation of missile technologies. Treaties such as the Missile Technology Control Regime (MTCR) aim to prevent the spread of missile systems capable of delivering weapons of mass destruction. Compliance with these regulations can influence market dynamics, as countries may seek to develop alternative systems that adhere to treaty obligations while still enhancing their military capabilities. The ongoing discussions around arms control may lead to shifts in defense strategies, impacting the demand for certain types of rockets and missiles. This regulatory landscape is crucial for understanding future market trends.

Emerging Space Programs and Satellite Launches

The Rockets and Missiles Market Industry is also being shaped by the emergence of new space programs and the increasing frequency of satellite launches. As nations strive to establish a presence in space, the demand for launch vehicles is on the rise. Countries like India and China are expanding their space capabilities, which necessitates the development of advanced rockets. The commercial space sector is also contributing to this trend, with private companies investing heavily in launch technologies. This growing interest in space exploration and satellite deployment is likely to create new opportunities for the rockets and missiles market, as innovative solutions are required to meet these demands.

Geopolitical Instability and Regional Conflicts

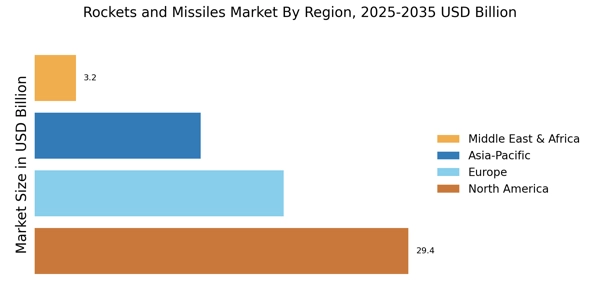

The Rockets and Missiles Market Industry is significantly influenced by geopolitical instability and ongoing regional conflicts. Areas experiencing heightened tensions, such as the Middle East and Eastern Europe, are witnessing increased military expenditures as nations seek to bolster their defense capabilities. The proliferation of missile technology among various states is a growing concern, prompting countries to invest in advanced missile systems to counter potential threats. This environment of uncertainty is likely to drive demand for both offensive and defensive missile systems, as nations aim to secure their borders and maintain strategic advantages. The market is expected to respond dynamically to these geopolitical developments.

Technological Innovations in Rockets and Missiles

The Rockets and Missiles Market Industry is experiencing a surge in technological innovations, particularly in propulsion systems and guidance technologies. Advanced materials and manufacturing techniques are enhancing the performance and reliability of missile systems. For instance, the integration of artificial intelligence in targeting systems is expected to improve accuracy and reduce collateral damage. The market is projected to grow at a compound annual growth rate of approximately 5.2% from 2025 to 2030, driven by these advancements. Furthermore, the development of hypersonic missiles, which can travel at speeds exceeding Mach 5, is likely to reshape strategic military capabilities, making them a focal point in defense budgets worldwide.