Expansion of Distribution Channels

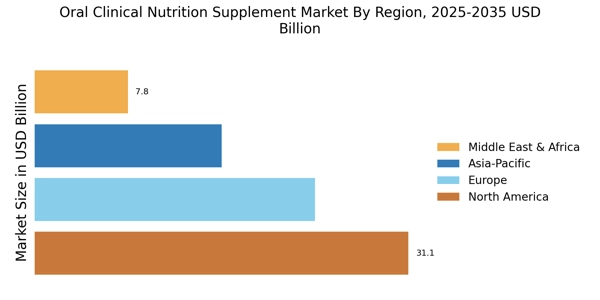

The expansion of distribution channels is playing a crucial role in the Oral Clinical Nutrition Supplement Market. With the rise of e-commerce and online retail platforms, consumers now have greater access to a variety of nutritional products. This shift is particularly relevant as more individuals prefer the convenience of purchasing supplements online. Data indicates that online sales of dietary supplements have surged, accounting for a significant portion of total sales. As companies adapt to this trend by enhancing their online presence and optimizing supply chains, the market is likely to experience accelerated growth, reaching a broader audience and increasing overall sales.

Growing Demand for Personalized Nutrition

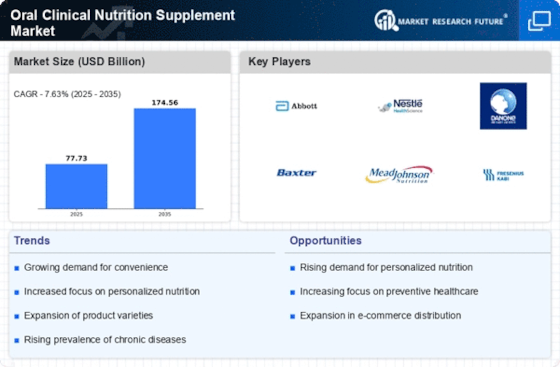

The shift towards personalized nutrition is becoming a pivotal factor in the Oral Clinical Nutrition Supplement Market. Consumers are increasingly seeking tailored solutions that address their specific health needs and preferences. This trend is supported by advancements in genetic testing and nutritional science, which allow for more customized dietary recommendations. Market data indicates that the personalized nutrition segment is expected to grow at a compound annual growth rate of over 10% in the coming years. As a result, companies are likely to invest in research and development to create products that align with individual health profiles, thus driving the overall market forward.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as diabetes, cardiovascular disorders, and obesity appears to be a significant driver for the Oral Clinical Nutrition Supplement Market. As healthcare systems increasingly focus on preventive care, nutritional supplements are being recognized for their role in managing these conditions. According to recent data, nearly 60% of adults in certain regions are living with at least one chronic condition, which necessitates dietary interventions. This trend suggests a growing demand for oral clinical nutrition supplements that can provide essential nutrients and support overall health. Consequently, manufacturers are likely to innovate and expand their product lines to cater to this demographic, thereby enhancing market growth.

Regulatory Support for Nutritional Products

Regulatory support for nutritional products is emerging as a key driver in the Oral Clinical Nutrition Supplement Market. Governments and health organizations are increasingly recognizing the importance of nutrition in public health, leading to favorable regulations that promote the development and marketing of dietary supplements. This supportive environment encourages innovation and ensures that products meet safety and efficacy standards. Recent initiatives aimed at improving nutritional guidelines and promoting dietary supplements are likely to enhance consumer confidence. As a result, the market may witness a surge in new product launches and an overall increase in demand for oral clinical nutrition supplements.

Rising Awareness of Nutritional Deficiencies

There is a growing awareness regarding nutritional deficiencies among various populations, which is influencing the Oral Clinical Nutrition Supplement Market. Many individuals, particularly the elderly and those with specific health conditions, are at risk of inadequate nutrient intake. Reports suggest that approximately 30% of older adults experience malnutrition, highlighting the need for effective nutritional solutions. This awareness is prompting healthcare professionals to recommend oral clinical nutrition supplements as a viable option to bridge dietary gaps. Consequently, the market is likely to see an increase in demand for products that are specifically formulated to address these deficiencies, thereby fostering growth.