Optocoupler IC Market Summary

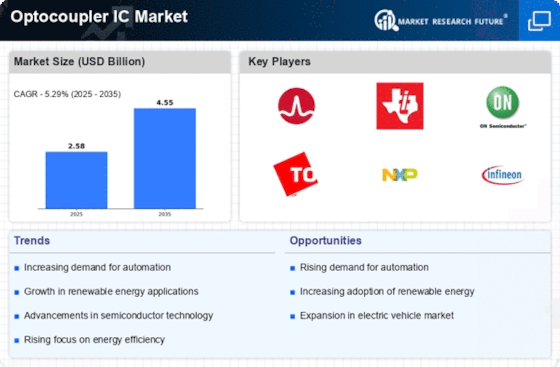

As per Market Research Future analysis, the Optocoupler IC Market Size was estimated at 2.58 USD Billion in 2024. The Optocoupler IC industry is projected to grow from 2.717 USD Billion in 2025 to 4.55 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.29% during the forecast period 2025 - 2035

Key Market Trends & Highlights

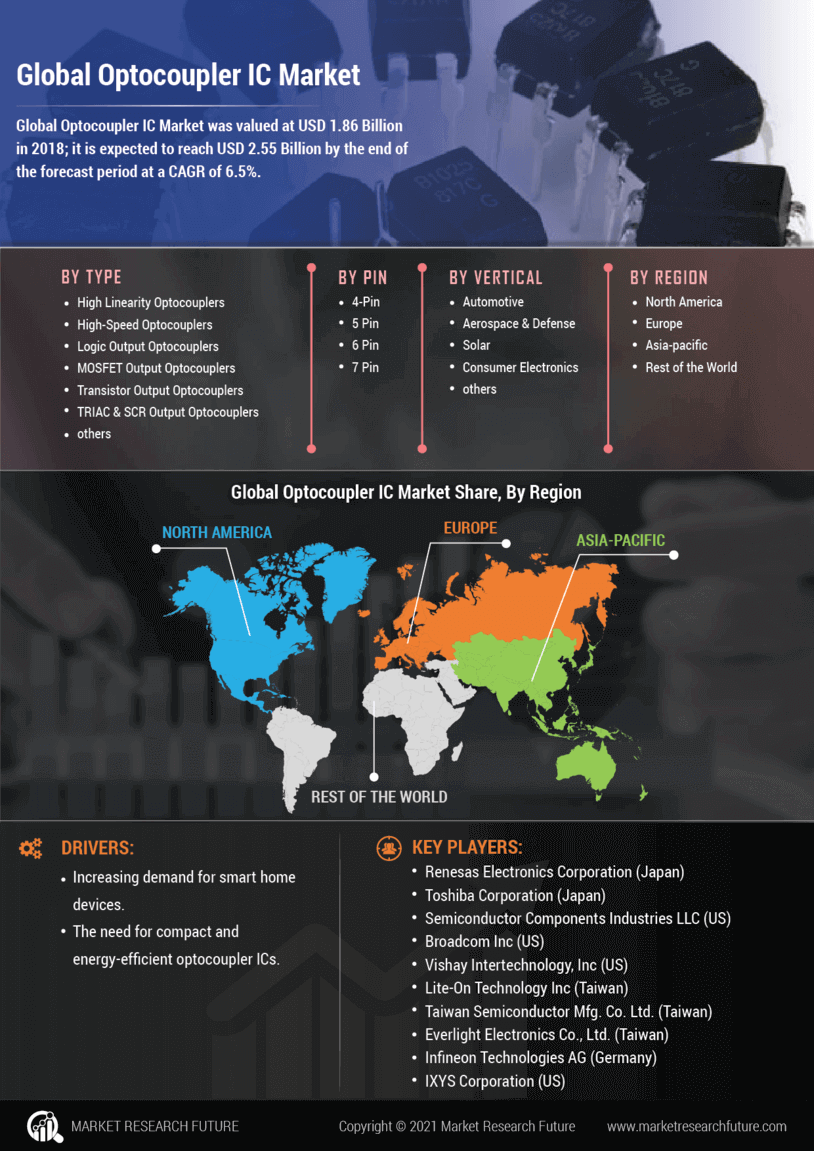

The Optocoupler IC Market is poised for substantial growth driven by technological advancements and increasing demand for energy efficiency.

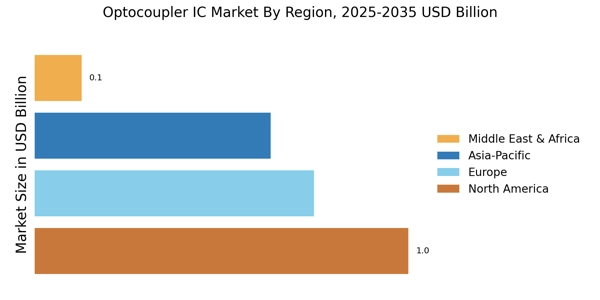

- North America remains the largest market for optocoupler ICs, driven by robust industrial automation and consumer electronics sectors.

- The Asia-Pacific region is the fastest-growing market, fueled by rapid advancements in electric vehicle infrastructure and smart technologies.

- High-speed optocouplers dominate the market, while high linearity optocouplers are experiencing the fastest growth due to their enhanced performance capabilities.

- Key market drivers include the increasing adoption of renewable energy sources and the expansion of electric vehicle infrastructure, which are shaping the industry's future.

Market Size & Forecast

| 2024 Market Size | 2.58 (USD Billion) |

| 2035 Market Size | 4.55 (USD Billion) |

| CAGR (2025 - 2035) | 5.29% |

Major Players

Broadcom (US), Texas Instruments (US), ON Semiconductor (US), Toshiba (JP), NXP Semiconductors (NL), Infineon Technologies (DE), Mitsubishi Electric (JP), Vishay Intertechnology (US), Renesas Electronics (JP)