Optical Coatings Size

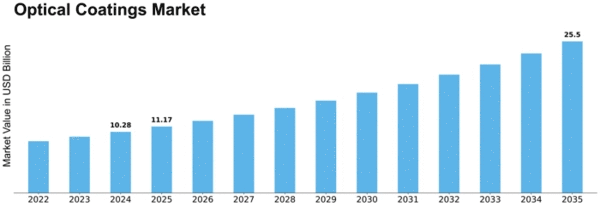

Optical Coatings Market Growth Projections and Opportunities

Various market factors significantly influence the growth trajectory of the Optical Coating Market. One of the major drivers is the growing demand for optical coatings in numerous sectors, such as electronics, healthcare, and telecommunications. The optical coatings market is estimated to Register a CAGR of 8.5%, amounting to USD 19.0 billion during 2021-2030; this will result from global market trends. Furthermore, increased consumer electronic devices such as smartphones, tablets, and cameras have fueled demand for optical coatings that protect fragile optical surfaces and enhance image quality. With their proliferation into everyday life, these gadgets drive up demand for coatings offering scratch resistance, water repellency, and anti-fingerprint properties. Additionally, consumers' desire for high-end screen displays and camera lenses also propels the market. Environmental concerns and the adoption of sustainable practices are becoming vital in determining the direction of the optical coating market. To comply with environmental regulations and decrease carbon footprint, manufacturers are increasingly concentrating on developing environmentally friendly coating technologies. Moreover, there are several other economic factors, including global economic trends and geopolitical considerations, that play a very important role when it comes to shaping the optical coating sector. Changes in currency exchange rates, trade wars, or recessions can influence raw material costs as well as manufacturing processes, leading to higher costs of producing/coating products used in optics, hence affecting their pricing & profitability directly again because they're sold worldwide under different currencies with varying inflation rates per country. The research & development space constitutes another significant determinant of the industry's characteristics on the market side. Ongoing innovations in materials used for coating work together with new technologies, thereby transforming this sector completely over time. Expenditures on R&D by major players towards partnering with institutions conducting studies based around cutting-edge coatings that exhibit best-in-class features. Competitor dynamics and mergers and acquisitions also shape the optical coating industry. Key players' presence, M&A process, or strategic alliances drive market competition and overall market share of individual firms. Regulations are another element that influences the optical coating sector. Some materials used in the production processes of optics have strict regulations, particularly when they have environmental implications, which might affect companies' production activities & their product lines as well since there is compliance with such rules must be met by manufacturers to facilitate access to markets where consumers reside while ensuring positive public opinion about them.

Leave a Comment