Market Trends

Introduction

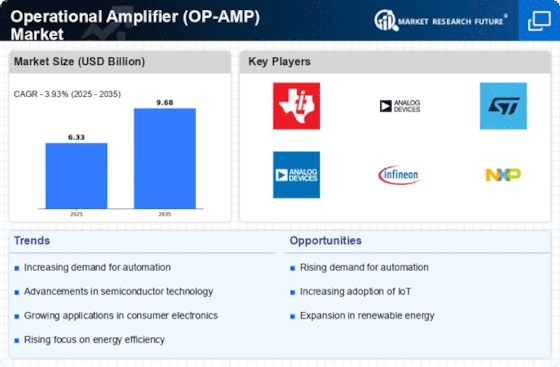

The Operational Amplifier (OP-AMP) market is expected to undergo significant changes by 2024, driven by the confluence of technological developments, regulatory pressures and changes in customer behavior. The rapid integration of IoT devices and the increasing demand for high-performance analog solutions are reshaping the landscape and driving manufacturers to innovate and improve their products. Besides, regulations to reduce energy consumption and e-waste are influencing the design and manufacturing processes. The growing demand for smaller and more efficient devices is also expected to increase the need for more versatile OP-AMP solutions. The market is highly complex, and understanding these trends is vital for all stakeholders in order to navigate the complexities and capitalize on the emerging opportunities.

Top Trends

-

Increased Demand for Low-Power OP-AMPs

The trend towards energy-saving devices is causing a growing demand for low-power operational amplifiers, especially in battery-powered applications. The market leaders are responding with a new generation of products that consume less than 1 mA of current. For example, several models of the TI company have been introduced which meet these criteria and can thus significantly increase the battery life of the devices they power. This trend will probably lead to a wider use of operational amplifiers in the field of the Internet of Things, where power consumption is crucial. -

Integration of OP-AMPs in Automotive Applications

The automobile industry is increasingly integrating OP-AMPs into its systems for advanced driver assistance systems (ADAS) and electric vehicles (EVs). The more the OP-AMPs are able to meet the stringent safety and performance requirements of automobiles, the more they are able to be used in these systems. The more they are used, the more important they become. The drive toward EVs will increase the demand for reliable and efficient OP-AMPs, which will affect the design and manufacturing processes in the automobile industry. -

Growth in Consumer Electronics

OP-AMPS are presently being used in a wide variety of products, particularly in the field of audio and video. Sales of OP-AMPS for hi-fi equipment are growing rapidly because of the increased demand for high-quality sound. This trend is likely to continue, because of the tendency of manufacturers to improve the performance of their products. -

Advancements in Precision OP-AMPs

For the same reasons, the use of OP-AMPS in medical and industrial applications is on the rise. New OP-AMPS have been developed which have very low input bias and drift, which are of the utmost importance for the accuracy of sensitive measurements. The demand for these OP-AMPS is expected to grow as the industry becomes more dependent on accurate measurements. This in turn will have an effect on R & D expenditure in this field. -

Miniaturization and Integration Trends

Miniaturization in the field of electronics is pushing manufacturers to develop smaller, more integrated OP-AMP solutions. NXP has introduced compact OP-AMPs that combine several functions in one package, thereby reducing the space needed on the printed circuit board. This is particularly important for mobile devices, and as technology continues to develop, this trend is expected to continue. As a result, it is expected that the complexity of the systems will increase, leading to more capable and complex systems. -

Emergence of Smart Sensors

A smart sensor that uses a op-amp as a signal amplifier is widely used in various fields, such as in the field of environment monitoring and smart homes. This field is one of the most active fields for op-amp development, and a company like Maxim Integrated is doing research on this front. As the smart technology develops, the market will expand. -

Focus on High-Speed OP-AMPs

High-speed operational amplifiers are becoming increasingly important in telecommunications and data processing applications. Renesas has developed a high-speed op amp that can handle data rates of up to 1GHz. As the speed of data transfer continues to increase, the demand for these high-speed op amps is expected to rise. -

Sustainability and Eco-Friendly Designs

As for the OP-amp market, manufacturers are concentrating on developing green materials and production methods. Cirrus Logic is the industry leader in this respect, and its green initiatives are aligned with the world’s sustainable development goals. This trend is expected to influence the consumers’ demand and the regulatory standards, so that more companies will adopt green practices. -

Rise of Programmable OP-AMPs

Because of their flexibility in a variety of applications, programmable op amps are gaining in popularity. Companies are investing in this technology to meet the varying needs of their customers and to offer products that can be reconfigured for different tasks. This is expected to increase efficiency and reduce costs, as users can adapt a single device for different applications without needing to purchase several components. -

Increased Collaboration and Partnerships

There is a general trend towards collaboration between the chip manufacturers and technology companies. There are now a number of joint ventures between the leading companies. This is expected to accelerate the development of new op amps and make the market more competitive.

Conclusion: Navigating the OP-AMP Market Landscape

The operational amplifier market in 2024 will be characterized by a highly competitive and fragmented environment, with the emergence of new players and the competition of the established players. Regions will see a rise in demand, especially in Asia-Pacific and North America, mainly in the field of consumer electronics and the automobile. Strategically, vendors should position themselves to gain a competitive advantage in artificial intelligence, automation, green and flexibility. The established players are working to increase their product portfolio and integrate smart technology, while the new entrants are working to develop sustainable practices and flexible manufacturing processes. In the long run, the ability to adapt to the change in the needs of consumers and the development of technology will be the key to leadership in the market.

Leave a Comment