Rise of the Gig Economy

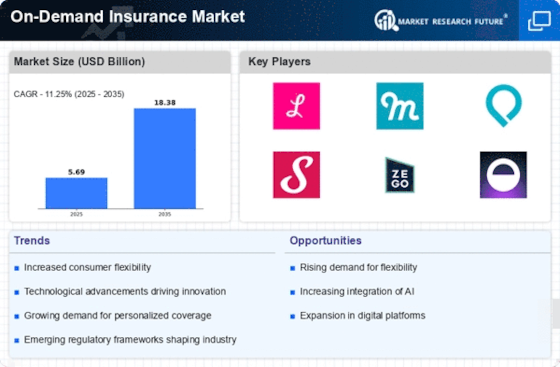

The On-Demand Insurance Market is experiencing a notable surge due to the rise of the gig economy. As more individuals engage in freelance and contract work, the need for flexible insurance solutions becomes paramount. Gig workers often lack traditional employment benefits, making on-demand insurance an attractive option. According to recent data, approximately 36% of the workforce is now involved in gig work, highlighting a significant shift in employment patterns. This trend suggests that the On-Demand Insurance Market must adapt to cater to the unique needs of this demographic, offering tailored coverage that aligns with their fluctuating income and work schedules. As the gig economy continues to expand, the demand for on-demand insurance solutions is likely to grow, presenting opportunities for insurers to innovate and diversify their offerings.

Changing Consumer Preferences

Consumer preferences are shifting towards more personalized and flexible insurance solutions, driving growth in the On-Demand Insurance Market. Today's consumers are increasingly seeking coverage that aligns with their specific needs and lifestyles, rather than traditional, one-size-fits-all policies. This trend is particularly evident among younger demographics, who prioritize convenience and customization. Recent surveys indicate that over 70% of millennials express interest in on-demand insurance options that allow them to purchase coverage for specific events or timeframes. This shift in consumer behavior suggests that insurers must adapt their offerings to remain relevant. By embracing this trend, the On-Demand Insurance Market can cater to a more diverse clientele, ultimately enhancing customer satisfaction and loyalty.

Regulatory Changes and Compliance

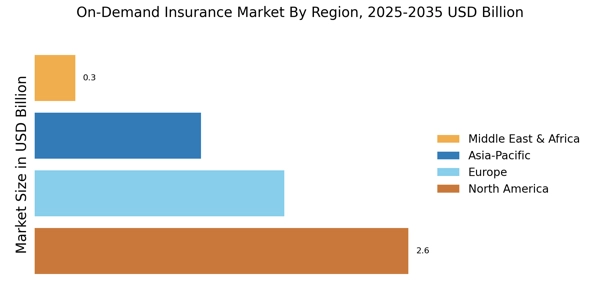

Regulatory changes are influencing the On-Demand Insurance Market, as governments worldwide seek to adapt insurance frameworks to accommodate new business models. As on-demand insurance products gain popularity, regulators are increasingly focused on ensuring consumer protection and market stability. This evolving regulatory landscape may present challenges for insurers, as they must navigate compliance requirements while innovating their product offerings. For instance, recent legislative efforts in various regions aim to clarify the legal status of on-demand insurance, which could impact how these products are marketed and sold. Insurers that proactively engage with regulatory bodies and adapt to these changes may find themselves at a competitive advantage. Thus, the On-Demand Insurance Market must remain vigilant and responsive to regulatory developments to thrive in this dynamic environment.

Increased Awareness of Insurance Needs

There is a growing awareness among consumers regarding their insurance needs, which is significantly impacting the On-Demand Insurance Market. As individuals become more informed about the risks associated with their lifestyles, they are increasingly seeking insurance solutions that provide adequate coverage. This heightened awareness is partly driven by the proliferation of information available through digital platforms and social media. Recent studies suggest that nearly 60% of consumers now actively research insurance options before making a purchase, indicating a shift towards more informed decision-making. This trend presents an opportunity for insurers to educate potential customers about the benefits of on-demand insurance, thereby fostering a more knowledgeable consumer base. By addressing these evolving consumer insights, the On-Demand Insurance Market can enhance its outreach and engagement strategies.

Technological Advancements in Insurance

Technological advancements are reshaping the On-Demand Insurance Market, enabling insurers to offer more personalized and efficient services. The integration of artificial intelligence, machine learning, and big data analytics allows for real-time risk assessment and pricing models that are more aligned with individual consumer behavior. For instance, the use of mobile applications facilitates instant policy issuance and claims processing, enhancing customer experience. Recent statistics indicate that the adoption of technology in insurance could lead to a 20% reduction in operational costs for insurers. This technological evolution not only streamlines processes but also fosters a competitive landscape where agility and responsiveness are crucial. As technology continues to evolve, the On-Demand Insurance Market is poised to leverage these advancements to meet the dynamic needs of consumers.