Rising Financial Literacy

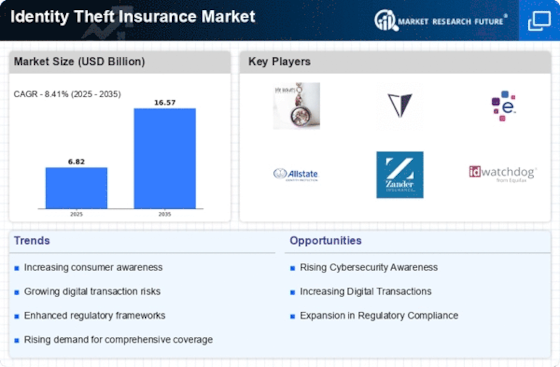

Rising financial literacy among consumers is contributing to the growth of the Identity Theft Insurance Market. As individuals become more educated about personal finance and the implications of identity theft, they are more inclined to seek out insurance products that provide coverage against such risks. Surveys indicate that consumers are increasingly aware of the potential financial consequences of identity theft, leading to a greater willingness to invest in protective measures. This heightened awareness suggests that the Identity Theft Insurance Market may experience an uptick in demand as consumers prioritize safeguarding their financial well-being.

Evolving Digital Landscape

The evolving digital landscape plays a crucial role in shaping the Identity Theft Insurance Market. With the proliferation of online transactions and digital services, the potential for identity theft has escalated. Data from cybersecurity firms indicates that cybercriminals are increasingly targeting personal information through sophisticated methods. As more consumers engage in online activities, the likelihood of identity theft incidents rises, prompting a greater need for insurance solutions. This shift towards digitalization suggests that the Identity Theft Insurance Market could see a surge in demand as individuals and businesses seek to mitigate the risks associated with their online presence.

Growing Regulatory Frameworks

The establishment of growing regulatory frameworks is influencing the Identity Theft Insurance Market. Governments are implementing stricter regulations to protect consumer data and privacy, which in turn drives the demand for identity theft insurance. For instance, regulations such as the General Data Protection Regulation (GDPR) have heightened awareness regarding data protection. As organizations face increased scrutiny and potential penalties for data breaches, they are more likely to invest in identity theft insurance to safeguard against financial repercussions. This trend indicates that the Identity Theft Insurance Market may benefit from a more robust regulatory environment that encourages businesses to adopt protective measures.

Increasing Incidence of Identity Theft

The rising incidence of identity theft is a primary driver for the Identity Theft Insurance Market. Reports indicate that millions of individuals fall victim to identity theft each year, leading to significant financial losses. In 2023, the Federal Trade Commission reported over 1.4 million identity theft complaints, highlighting the urgent need for protective measures. As consumers become more aware of the risks associated with identity theft, the demand for insurance products that offer coverage against such threats is likely to increase. This trend suggests that the Identity Theft Insurance Market may experience substantial growth as individuals seek to safeguard their personal information and financial assets.

Technological Advancements in Fraud Detection

Technological advancements in fraud detection are shaping the Identity Theft Insurance Market. Innovations in artificial intelligence and machine learning are enabling more effective identification and prevention of identity theft. These technologies allow for real-time monitoring of transactions and alerts for suspicious activities, thereby reducing the likelihood of identity theft incidents. As these technologies become more integrated into insurance offerings, consumers may be more inclined to purchase identity theft insurance that incorporates advanced fraud detection capabilities. This trend indicates that the Identity Theft Insurance Market could see increased adoption as technology enhances the effectiveness of protective measures.