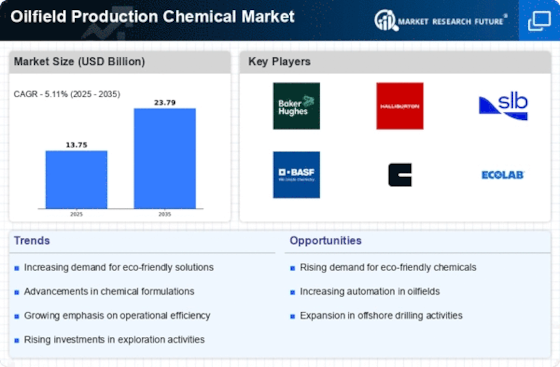

Increasing Demand for Enhanced Oil Recovery

The Oilfield Production Chemical Market is experiencing a notable surge in demand for enhanced oil recovery (EOR) techniques. As conventional oil reserves deplete, operators are increasingly turning to EOR methods to maximize extraction from existing fields. This trend is driven by the need to maintain production levels and optimize resource utilization. According to recent estimates, EOR could account for up to 30% of total oil production in certain regions. The use of specialized chemicals, such as surfactants and polymers, plays a crucial role in improving oil mobility and recovery rates. Consequently, the growing emphasis on EOR is likely to propel the Oilfield Production Chemical Market forward, as companies seek innovative solutions to enhance their operational efficiency.

Regulatory Pressures and Environmental Compliance

The Oilfield Production Chemical Market is also shaped by regulatory pressures and the need for environmental compliance. Governments and regulatory bodies are implementing stricter guidelines regarding the use of chemicals in oil production, emphasizing the importance of minimizing environmental impact. This has led to an increased demand for eco-friendly and biodegradable production chemicals. Companies are now required to invest in compliant chemical solutions that not only meet regulatory standards but also address public concerns regarding environmental sustainability. As a result, the Oilfield Production Chemical Market is likely to witness a shift towards more sustainable practices, driven by both regulatory requirements and consumer expectations.

Focus on Operational Efficiency and Cost Reduction

In the Oilfield Production Chemical Market, there is a pronounced focus on operational efficiency and cost reduction. Companies are under constant pressure to optimize their production processes while minimizing expenses. The integration of advanced chemical solutions can lead to significant improvements in production efficiency, reducing downtime and enhancing overall output. For instance, the use of corrosion inhibitors and scale removers can prolong equipment life and reduce maintenance costs. As operators strive to achieve better margins in a competitive landscape, the demand for innovative production chemicals that facilitate cost-effective operations is likely to increase, thereby bolstering the Oilfield Production Chemical Market.

Technological Innovations in Chemical Formulations

Technological innovations in chemical formulations are playing a pivotal role in shaping the Oilfield Production Chemical Market. The development of new and improved chemical products, tailored to meet specific operational challenges, is becoming increasingly prevalent. Innovations such as nanotechnology and bio-based chemicals are gaining traction, offering enhanced performance and reduced environmental impact. These advancements not only improve the efficiency of oil extraction processes but also align with sustainability goals. As companies seek to adopt greener practices, the demand for innovative chemical solutions is expected to rise, further propelling the Oilfield Production Chemical Market into a new era of efficiency and environmental responsibility.

Rising Exploration Activities in Unconventional Resources

The Oilfield Production Chemical Market is significantly influenced by the rising exploration activities in unconventional resources, such as shale oil and tight gas. As traditional oil fields mature, energy companies are increasingly investing in unconventional plays to meet the ever-growing energy demand. The extraction of these resources often requires advanced chemical solutions to address challenges such as high viscosity and low permeability. Reports indicate that the unconventional oil and gas sector could represent a substantial portion of future production growth. This shift towards unconventional resources necessitates the use of specialized production chemicals, thereby driving the Oilfield Production Chemical Market as companies adapt to new extraction methodologies.