Growing Energy Demand

The Oil-Immersed Power Transformer Market is significantly influenced by the rising global energy demand. As populations grow and economies develop, the need for reliable and efficient power distribution systems becomes paramount. According to recent data, energy consumption is projected to increase by approximately 25% over the next decade. This surge in demand necessitates the expansion and modernization of electrical infrastructure, including the deployment of oil-immersed power transformers. These transformers are favored for their ability to handle high loads and provide stable voltage levels, making them essential for meeting the increasing energy requirements in various sectors.

Rising Urbanization and Industrialization

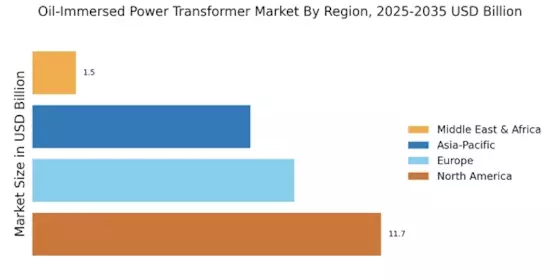

The Oil-Immersed Power Transformer Market is significantly impacted by rising urbanization and industrialization trends. As urban areas expand and industries grow, the demand for robust electrical infrastructure increases. Urbanization leads to higher electricity consumption, necessitating the installation of efficient power transformers to support residential and commercial needs. Additionally, industrial sectors require reliable power supply for operations, further driving the demand for oil-immersed transformers. The trend of rapid urbanization, particularly in developing regions, suggests a sustained growth trajectory for the Oil-Immersed Power Transformer Market, as these transformers are integral to meeting the energy needs of burgeoning urban centers.

Technological Advancements in Transformer Design

The Oil-Immersed Power Transformer Market is experiencing a notable shift due to advancements in transformer design and manufacturing processes. Innovations such as improved insulation materials and enhanced cooling systems are contributing to the efficiency and reliability of transformers. These technological improvements not only extend the lifespan of transformers but also reduce maintenance costs. For instance, the introduction of smart transformers equipped with monitoring systems allows for real-time data analysis, which can lead to proactive maintenance and reduced downtime. As a result, the market is likely to see increased adoption of these advanced transformers, which could drive growth in the Oil-Immersed Power Transformer Market.

Increased Investment in Renewable Energy Projects

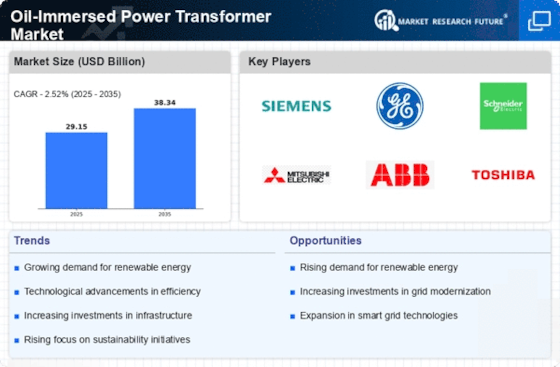

The Oil-Immersed Power Transformer Market is poised for growth due to increased investments in renewable energy projects. As countries strive to transition to cleaner energy sources, the demand for efficient power distribution systems becomes critical. Oil-immersed transformers play a vital role in integrating renewable energy into existing grids, ensuring stability and reliability. Recent reports indicate that investments in renewable energy are expected to reach trillions of dollars in the coming years. This influx of capital is likely to drive the adoption of oil-immersed transformers, as they are essential for managing the variable nature of renewable energy sources.

Regulatory Support for Infrastructure Development

The Oil-Immersed Power Transformer Market benefits from regulatory frameworks that support infrastructure development. Governments are increasingly investing in energy infrastructure to ensure reliable power supply and to meet sustainability goals. Policies promoting the modernization of electrical grids and the integration of renewable energy sources are likely to drive demand for oil-immersed transformers. For example, initiatives aimed at enhancing grid resilience and reducing transmission losses are expected to create opportunities for the Oil-Immersed Power Transformer Market. This regulatory support is crucial for fostering an environment conducive to market growth.