Growing Demand for Energy

The increasing global demand for energy is a critical factor driving the Global Oil and Gas Corrosion Protection Market Industry. As countries strive to meet energy needs, the expansion of oil and gas exploration and production activities is inevitable. This expansion necessitates robust corrosion protection measures to safeguard infrastructure against deterioration. The market's growth trajectory, reaching 52.7 USD Billion in 2024, reflects the industry's response to heightened energy demands. Consequently, companies are prioritizing corrosion management to ensure operational efficiency and minimize downtime, which is essential for meeting the rising energy requirements.

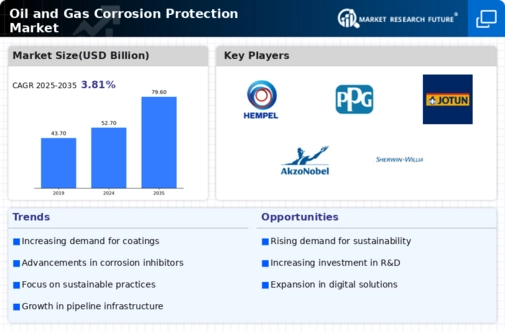

Market Growth Projections

The Global Oil and Gas Corrosion Protection Market Industry is projected to experience substantial growth over the coming years. With an estimated market value of 52.7 USD Billion in 2024, the industry is poised for a robust expansion trajectory. The anticipated CAGR of 3.81% from 2025 to 2035 indicates a steady increase in demand for corrosion protection solutions. This growth is likely driven by factors such as rising infrastructure investments, regulatory compliance, and technological advancements. As the industry adapts to evolving challenges, the focus on effective corrosion management will remain paramount in ensuring the longevity and reliability of oil and gas assets.

Regulatory Compliance and Standards

Stringent regulations and standards regarding environmental protection and safety are pivotal drivers within the Global Oil and Gas Corrosion Protection Market Industry. Regulatory bodies are enforcing compliance measures that require companies to implement effective corrosion management strategies. This compliance not only mitigates environmental risks but also enhances operational efficiency. As a result, organizations are increasingly investing in advanced corrosion protection technologies to meet these standards. The anticipated growth of the market to 79.6 USD Billion by 2035 underscores the critical role of regulatory frameworks in shaping industry practices and promoting sustainable operations.

Increasing Infrastructure Investment

The Global Oil and Gas Corrosion Protection Market Industry is experiencing a notable boost due to rising investments in infrastructure development. Governments and private entities are allocating substantial budgets to enhance oil and gas facilities, which necessitates effective corrosion protection solutions. For instance, the global market is projected to reach 52.7 USD Billion in 2024, driven by the need for maintaining the integrity of pipelines and storage tanks. This trend indicates a growing recognition of the importance of corrosion management in extending asset life and reducing maintenance costs, thereby fostering a more sustainable operational environment.

Technological Advancements in Coatings

Innovations in corrosion-resistant coatings are significantly influencing the Global Oil and Gas Corrosion Protection Market Industry. Advanced materials, such as nanocoatings and smart coatings, offer enhanced protection against corrosive environments. These technologies not only improve the lifespan of assets but also reduce maintenance frequency and costs. The integration of these advanced coatings is expected to contribute to the market's growth, with a projected CAGR of 3.81% from 2025 to 2035. Companies are increasingly adopting these innovations to enhance their corrosion management strategies, thereby ensuring the longevity and reliability of their operations.

Focus on Sustainability and Environmental Protection

The Global Oil and Gas Corrosion Protection Market Industry is increasingly influenced by the focus on sustainability and environmental protection. Companies are recognizing the need to adopt eco-friendly corrosion protection solutions that minimize environmental impact. This shift is driven by both regulatory pressures and consumer expectations for sustainable practices. As a result, the market is evolving towards the development of biodegradable and less harmful corrosion inhibitors. The anticipated growth to 79.6 USD Billion by 2035 highlights the industry's commitment to sustainability, as organizations seek to balance operational efficiency with environmental stewardship.