Top Industry Leaders in the Off-Road Equipment Market

*Disclaimer: List of key companies in no particular order

Latest Off-Road Equipment Market Company Updates:

Competitive Landscape of the Off-Road Equipment Market: Unveiling Strategies and Trends

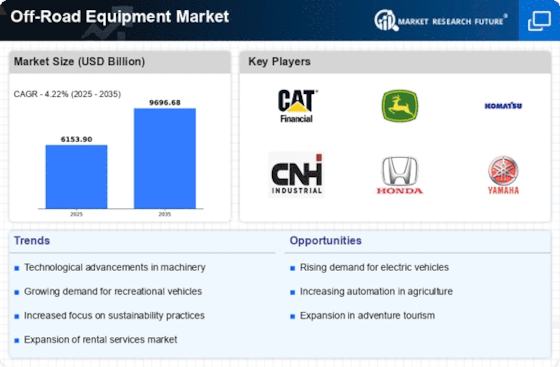

The off-road equipment market, estimated at a substantial USD 370 billion in 2022, is a rugged terrain where industry giants battle for dominance. Understanding the competitive landscape is crucial for navigating this dynamic domain.

Key Player Strategies:

Market Leaders: Established players like Caterpillar, Komatsu, and John Deere leverage their extensive product portfolios, global reach, and brand recognition to maintain strong market shares. They invest heavily in R&D, focusing on automation, electrification, and fuel efficiency to stay ahead of the curve.

Regional Champions: Companies like XCMG and Zoomlion from China are capturing significant market share through cost-effective offerings and strategic partnerships with governments in developing economies.

Niche Players: Smaller companies are carving niches by specializing in specific equipment types or applications. They provide customized solutions with agility and cater to unique regional needs.

Factors for Market Share Analysis:

Product Mix: Offering a diverse range of equipment for various applications like excavation, construction, agriculture, and forestry grants a competitive edge.

Technological Prowess: Continuous innovation in areas like automation, alternative fuels, and safety features attracts customers and commands premium pricing.

Distribution Network and Service: A robust network of dealerships and efficient after-sales service significantly impact brand loyalty and market share.

Financial Strength and Pricing: Stable financials and competitive pricing strategies, especially in volatile economic climates, can bolster market presence.

New and Emerging Trends:

Electrification: The off-road industry is embracing electric and hybrid equipment to address environmental concerns and emission regulations. Leading manufacturers are investing heavily in developing robust and efficient electric powertrains for heavy machinery.

Autonomous Operations: Automation is reshaping the landscape, with autonomous excavators, tractors, and drones offering increased efficiency and reduced operational costs. Companies are collaborating with tech giants to accelerate development and adoption.

Data-Driven Solutions: Integration of sensors, AI, and cloud computing in off-road equipment enables predictive maintenance, real-time performance monitoring, and optimized fleet management. This trend is creating new revenue streams and enhancing customer value propositions.

Overall Competitive Scenario:

The off-road equipment market is characterized by intense competition, with established players battling new entrants and regional champions. Differentiation through technology, strategic partnerships, and customer-centric solutions is key to success. The rise of electrification, automation, and data-driven technologies is reshaping the landscape, demanding constant innovation and adaptation from market players. Companies that demonstrate agility, embrace these trends, and cater to evolving customer needs will be well-positioned to navigate the rugged terrain of the off-road equipment market and secure a sustained competitive advantage.

This analysis provides a snapshot of the competitive landscape, but ongoing market dynamics and unforeseen disruptions can change the course. Continuous monitoring and adaptation are vital for players to stay ahead of the curve and thrive in this dynamic market.

Caterpillar Inc. (Dec 15, 2023): Unveiled new Cat D6 Dozer with integrated GRADE technology for enhanced precision earthmoving. (Source: Caterpillar press release)

Kubota Corporation (Oct 27, 2023): Entered strategic partnership with Bosch to develop autonomous agricultural robots. (Source: Nikkei Asian Review)

CNH Industrial NV (Nov 09, 2023): Showcased new Case Construction Equipment methane-powered dozer prototype at Bauma trade show. (Source: Construction World)

Deere & Company (Nov 01, 2023): Partnered with Microsoft to implement cloud-based solutions for farm data management and automation. (Source: CNBC)

Komatsu Ltd (Oct 18, 2023): Completed acquisition of Sandvik Mining and Rock Technology division, expanding presence in underground mining equipment. (Source: Komatsu press release)

The Liebherr Group (Sep 29, 2023): Launched new R980 SME dozer model with enhanced safety features and operator comfort. (Source: Liebherr website)

Top listed global companies in the industry are:

Caterpillar Inc.

Kubota Corporation

CNH Industrial NV

Hitachi Construction Machinery

Deere & Company

Komatsu Ltd

Sandvik AB

The Liebherr Group

Blount International Inc.

Doosan Infracore