Top Industry Leaders in the Nuclear Fuels Market

*Disclaimer: List of key companies in no particular order

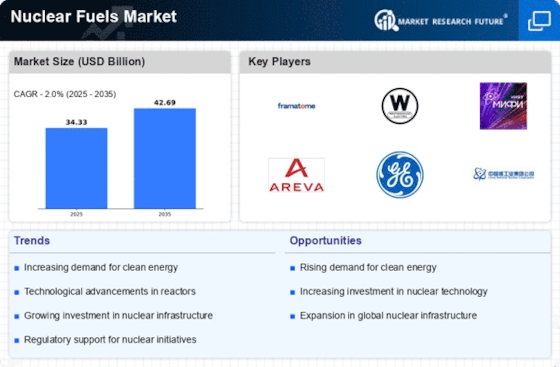

Competitive Landscape of the Nuclear Fuels Market: Navigating a Dynamic Terrain

The nuclear fuels market, encompassing uranium mining, conversion, enrichment, fuel fabrication, and reprocessing, presents a complex and dynamic competitive landscape. While demand for nuclear power fluctuates globally, market competition remains fierce, driven by factors like resource control, technological advancements, and regulatory frameworks. Understanding this landscape is crucial for stakeholders vying for success in this critical energy sector.

Key Players and Strategies:

- Cameco Corporation

- Kazatomprom

- Orano

- China National Nuclear Corporation (CNNC)

- Rosatom

- Energy Resources of Australia (ERA)

- BHP Group (Australia/Global)

- Uranium One

- Navoi Mining & Metallurgy Combinat (NMMC)

- NAC Kazatomprom Marketing AG

The market features a mix of established giants and nimble niche players. Leading the pack are Westinghouse Electric Company (US), Framatome (France), Orano (France), Centrus Energy Corporation (US), and China National Nuclear Corporation (CNNC). These players leverage their extensive experience, global reach, and diversified portfolios to maintain strong market positions. They employ strategies like vertical integration, long-term supply contracts, and technological innovation to secure market share and optimize costs.

However, smaller players like Cameco Corporation (Canada), Kazatomprom (Kazakhstan), and Rosatom (Russia) pose significant challenges by focusing on specific segments like uranium mining or enrichment. They often benefit from lower production costs and government subsidies, making them formidable competitors in their areas of expertise.

Factors for Market Share Analysis:

Several key factors influence market share dynamics in the nuclear fuels market. Uranium reserves and production capacities play a crucial role, with countries like Kazakhstan, Canada, and Australia holding significant sway. Conversion and enrichment capabilities are another critical factor, with limited facilities globally creating bottlenecks and influencing pricing power. Fuel fabrication expertise and proximity to nuclear power plants also provide distinct advantages. Additionally, reprocessing capabilities, while limited globally, are gaining traction due to sustainability concerns and resource scarcity.

Emerging Trends and Company Initiatives:

The nuclear fuels market is witnessing various exciting trends shaping future competition. Advanced reactor technologies like small modular reactors (SMRs) demand innovative fuel designs, creating opportunities for specialized players. Fuel recycling and reprocessing are gaining traction to maximize resource utilization and minimize waste, with companies like Orano and Urenco investing heavily in this area. Furthermore, digitalization and automation are transforming the sector, with players like Westinghouse and Framatome adopting them to enhance efficiency and safety.

Overall Competitive Scenario:

The nuclear fuels market presents a dynamic and evolving competitive landscape. Established players are adapting to changing market dynamics by diversifying their offerings, investing in new technologies, and expanding geographically. Meanwhile, niche players are carving out space with competitive pricing and specialized expertise. Factors like resource control, technological innovation, and regulatory frameworks will continue to influence market share. Additionally, the growing focus on sustainability and waste management is opening up new avenues for competition, particularly in reprocessing and advanced fuel designs.

Industry Developments and Latest Updates

Cameco Corporation (CCO)

- January 19, 2024: Cameco reports Q4 and full-year 2023 financial results: uranium sales volume increased 22% YoY (Cameco press release)

Orano

- February 9, 2024: Orano announces partnership with BWXT to develop advanced nuclear fuel recycling technologies (Orano press release)

- January 25, 2024: Orano reports Q4 and full-year 2023 financial results: revenue up 12% YoY (Orano press release)

Rosatom

- January 26, 2024: Rosatom reports 2023 financial results: revenue up 10% YoY (Rosatom press release)

Energy Resources of Australia (ERA)

- February 9, 2024: ERA reports Q1 FY24 uranium production of 3,491 tonnes (ERA investor presentation)

- November 21, 2023: ERA receives final regulatory approval for Ranger 3 Decommissioning Project (ERA press release)