Aging Population

The demographic shift towards an aging population in North America is a crucial factor influencing the vitamins market. As the baby boomer generation continues to age, there is a corresponding increase in the demand for vitamins and supplements that cater to the specific health needs of older adults. This demographic is particularly concerned with maintaining vitality and preventing age-related health issues, which drives the consumption of vitamins. Market data indicates that the segment of consumers aged 50 and above accounts for nearly 40% of total vitamin sales in the region. This trend suggests that the vitamins market will continue to expand as the population ages and seeks products that promote longevity and overall health.

Increasing Health Awareness

The growing awareness of health and wellness among consumers is a pivotal driver in the vitamins market. As individuals become more informed about the benefits of vitamins and supplements, they are increasingly incorporating these products into their daily routines. This trend is particularly pronounced in North America, where a significant portion of the population actively seeks to enhance their health through dietary supplements. According to recent data, approximately 70% of adults in the region report using vitamins regularly. This heightened focus on preventive health measures is likely to propel the vitamins market forward, as consumers prioritize their well-being and seek products that support their health goals.

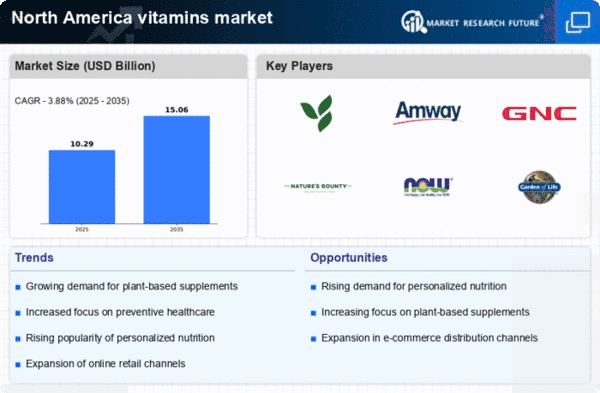

Expansion of Retail Channels

The expansion of retail channels is a vital driver in the vitamins market. With the rise of health-focused retail outlets and the integration of vitamins into mainstream grocery stores, consumers have greater access to a variety of vitamin products. This increased availability is particularly evident in North America, where health food stores and pharmacies are expanding their vitamin offerings. Furthermore, the growth of online retail platforms has made it easier for consumers to purchase vitamins from the comfort of their homes. Recent statistics show that online sales of vitamins have surged by 25% in the past year alone. This trend suggests that the vitamins market will continue to thrive as retail channels diversify and adapt to consumer preferences.

Innovative Product Development

Innovation in product formulation and delivery methods is a significant driver in the vitamins market. Manufacturers are increasingly focusing on developing new and improved vitamin products that cater to diverse consumer preferences. This includes the introduction of gummies, powders, and liquid forms, which appeal to different demographics, particularly younger consumers. Additionally, advancements in technology allow for enhanced bioavailability of vitamins, making them more effective. In North America, the market for innovative vitamin products is expected to grow by 15% annually, reflecting consumer demand for convenience and efficacy. This trend indicates that the vitamins market will continue to evolve as companies strive to meet the changing needs of consumers.

Rising Interest in Preventive Healthcare

The shift towards preventive healthcare is reshaping consumer behavior in the vitamins market. More individuals are recognizing the importance of maintaining health rather than merely treating illnesses. This proactive approach is leading to increased consumption of vitamins and dietary supplements as consumers aim to bolster their immune systems and overall health. In North America, the preventive healthcare market is projected to grow at a CAGR of 8% over the next five years, indicating a robust demand for vitamins. This trend reflects a broader societal movement towards health optimization, which is likely to sustain growth in the vitamins market as consumers prioritize preventive measures.