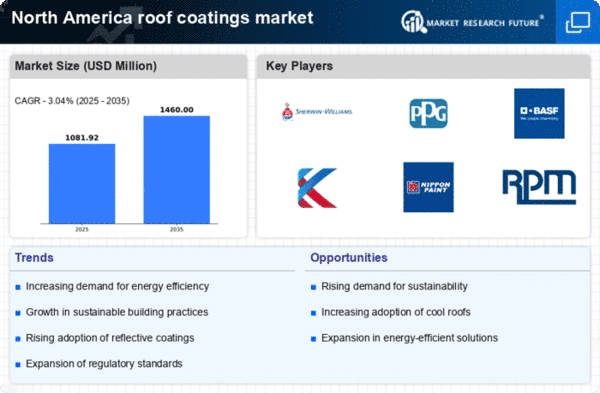

The North America roof coatings market is characterized by intense competition, with a diverse range of players offering a wide array of products and solutions tailored to various end-user needs. The competitive landscape is segmented among key market leaders, regional players, and new entrants, each aiming to capitalize on the growing demand for sustainable, energy-efficient, and durable roof coatings across residential, commercial, and industrial sectors.

The leading companies, including PPG Industries, Sherwin-Williams, GAF Materials Corporation, and Dow Inc., dominate the market with well-established distribution networks, strong brand recognition, and broad product portfolios. These companies invest heavily in research and development (R&D) to introduce innovative roof coatings that offer enhanced UV resistance, waterproofing capabilities, and energy-saving benefits, such as cool roofing technologies. Their large-scale production capacities and advanced formulations allow them to cater to diverse customer requirements and ensure compliance with stringent environmental regulations.

In addition to the major players, regional companies and niche market participants such as Tremco Incorporated, Henry Company, and Karnak Corporation also have a significant presence. These companies leverage their strong understanding of local market dynamics, climate conditions, and building codes to offer specialized products, such as elastomeric roof coatings, reflective coatings, and silicone-based solutions. These companies often target specific segments like commercial buildings, focusing on high-performance coatings that can withstand extreme weather conditions and reduce energy consumption.

The market has also seen the entry of smaller companies and start-ups that focus on sustainability trends by offering eco-friendly and bio-based roof coatings. These emerging players are driving innovation by developing products with low or zero volatile organic compounds (VOC) and enhanced thermal insulation properties. Their focus on green building standards and LEED certifications enables them to compete effectively in a market increasingly driven by environmental considerations and regulatory frameworks.

To strengthen their competitive positions, many players engage in strategic mergers, acquisitions, partnerships, and product innovations. For instance, collaborations between manufacturers and roofing contractors help expand market reach, while investments in new coating technologies drive product differentiation. Moreover, companies are increasingly focusing on offering value-added services like roof inspection, maintenance, and coating warranties, aiming to foster long-term customer relationships.

BASF SE: BASF SE, a chemical company, is the largest chemical producer in the world by revenue. BASF SE operates in 6+ segments, in which the key segments are chemicals, performance products, materials, nutrition & care, agricultural solutions, and others. BASF SE's coating products business segment is one of the company's most important business segments. The segment produces a wide variety of powder coating products. These products are used in a variety of applications, including automotive, construction, and electronics.

PPG Industries, Inc.: PPG Industries, Inc. is a prominent American multinational corporation headquartered in Pittsburgh, Pennsylvania, and recognized as a global leader in the production of paints, coatings, and specialty materials. Founded in 1883 as the Pittsburgh Plate Glass Company, PPG has evolved significantly over the years, expanding its product offerings and international footprint. Today, it operates in over 70 countries and is the largest coatings company by revenue, surpassing competitors like Sherwin-Williams. The company is structured into three primary business segments: coatings, glass, and chemicals.

Within the coatings segment, PPG provides a wide range of protective and decorative coatings for various applications, including automotive, industrial, and architectural markets. The automotive sector is particularly significant, with PPG supplying original equipment manufacturers (OEMs) and the automotive refinish market.

Leave a Comment