Growing Health Consciousness

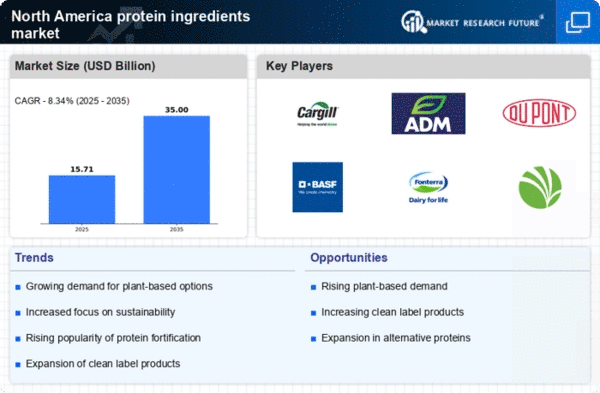

The increasing awareness of health and wellness among consumers in North America appears to be a primary driver for the protein ingredients market. As individuals become more health-conscious, they are actively seeking products that offer nutritional benefits, particularly those high in protein. This trend is reflected in the rising demand for protein-rich foods and supplements, which has been projected to grow at a CAGR of approximately 8% from 2023 to 2028. The protein ingredients market is witnessing a shift towards products that not only provide protein but also align with consumers' health goals, such as weight management and muscle recovery. This growing health consciousness is likely to continue influencing product development and marketing strategies within the industry.

Evolving Consumer Preferences

Evolving consumer preferences are reshaping the protein ingredients market in North America. Consumers are increasingly seeking transparency in food labeling and are more inclined towards products that are perceived as natural and minimally processed. This shift is prompting manufacturers within the protein ingredients market to reformulate their products to meet these expectations. The clean label trend is gaining traction, with a reported 60% of consumers willing to pay more for products with simple, recognizable ingredients. This evolving landscape suggests that companies must adapt to these preferences to remain competitive, potentially leading to innovations in product formulation and marketing strategies.

Innovation in Protein Sources

Innovation in protein sources is significantly impacting the protein ingredients market in North America. The emergence of alternative protein sources, such as insect protein and lab-grown meat, is diversifying the market landscape. These innovative sources are appealing to a broader audience, including those seeking sustainable and ethical food options. The protein ingredients market is adapting to these changes by incorporating novel protein sources into their product lines. For instance, the market for plant-based proteins is expected to reach $10 billion by 2026, indicating a robust growth trajectory. This innovation not only caters to evolving consumer preferences but also addresses environmental concerns, thereby enhancing the industry's appeal.

Expansion of E-commerce Channels

The expansion of e-commerce channels is significantly influencing the protein ingredients market in North America. With the rise of online shopping, consumers are increasingly purchasing protein products through digital platforms. This shift is providing manufacturers within the protein ingredients market with new opportunities to reach a broader audience. E-commerce sales of protein supplements and functional foods have seen a notable increase, with projections indicating a growth rate of 15% annually. This trend not only enhances accessibility for consumers but also allows for targeted marketing strategies that cater to specific demographics. As e-commerce continues to grow, it is likely to play a crucial role in shaping the future of the protein ingredients market.

Rising Demand for Sports Nutrition

The surge in interest in fitness and sports nutrition is driving the protein ingredients market in North America. As more individuals engage in physical activities and sports, the demand for protein supplements and functional foods is increasing. The protein ingredients market is responding to this trend by offering a variety of protein-enriched products tailored for athletes and fitness enthusiasts. According to recent estimates, the sports nutrition segment is projected to grow at a CAGR of 7% through 2027. This growth is indicative of a broader societal shift towards active lifestyles, which is likely to sustain the demand for protein ingredients that support muscle recovery and performance enhancement.