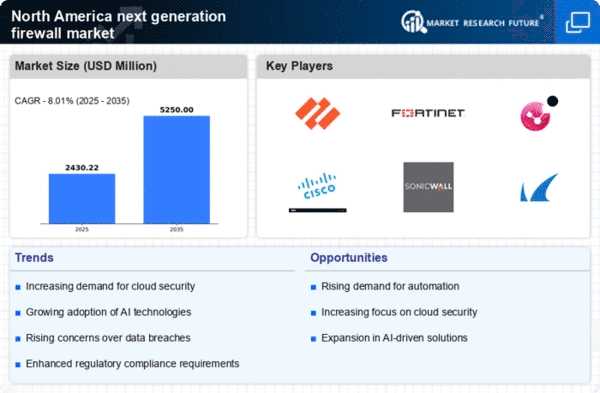

Rising Cybersecurity Threats

The escalating frequency and sophistication of cyber threats is a primary driver for the next generation-firewall market in North America. Organizations are increasingly targeted by advanced persistent threats (APTs), ransomware, and phishing attacks, necessitating robust security measures. In 2025, it is estimated that cybercrime will cost businesses globally over $10 trillion annually, highlighting the urgency for enhanced security solutions. As a result, enterprises are investing heavily in next generation-firewall technologies to protect sensitive data and maintain operational integrity. This trend is expected to propel the market forward, as companies seek to mitigate risks associated with data breaches and ensure compliance with industry standards. The next generation-firewall market is thus positioned to experience significant growth as organizations prioritize cybersecurity in their strategic planning.

Adoption of Remote Work Policies

The shift towards remote work has transformed the security landscape, driving demand for next generation-firewall solutions in North America. As organizations embrace flexible work arrangements, the need for secure access to corporate networks from various locations has become paramount. This trend has led to an increased reliance on virtual private networks (VPNs) and secure web gateways, which are often integrated with next generation-firewall technologies. In 2025, it is projected that remote work will account for approximately 30% of the workforce in North America, further emphasizing the necessity for advanced security measures. The next generation-firewall market is likely to benefit from this shift, as businesses seek to protect their digital assets while enabling employees to work securely from home or other remote locations.

Growing Demand for Unified Security Solutions

The increasing complexity of IT environments has led to a growing demand for unified security solutions, which is a significant driver for the next generation-firewall market in North America. Organizations are seeking to streamline their security infrastructure by integrating various security functions into a single platform. This approach not only simplifies management but also enhances overall security posture. In 2025, it is anticipated that the market for unified security solutions will grow at a CAGR of over 15%, reflecting the industry's shift towards comprehensive security frameworks. The next generation-firewall market is poised to capitalize on this trend, as businesses recognize the value of consolidating security tools to improve efficiency and reduce vulnerabilities.

Increased Investment in Digital Transformation

As organizations in North America continue to invest in digital transformation initiatives, the demand for next generation-firewall solutions is expected to rise. The transition to cloud-based services, IoT devices, and mobile applications necessitates advanced security measures to protect against emerging threats. In 2025, it is projected that spending on digital transformation will exceed $2 trillion, underscoring the critical need for robust cybersecurity solutions. The next generation-firewall market is likely to thrive as businesses prioritize security in their digital strategies, ensuring that their networks remain secure amidst rapid technological advancements. This investment in security infrastructure is essential for maintaining customer trust and safeguarding sensitive information.

Regulatory Pressures and Compliance Requirements

The evolving regulatory landscape in North America is a key driver for the next generation-firewall market. Organizations are increasingly subject to stringent compliance requirements related to data protection and privacy, such as the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR). These regulations mandate that businesses implement adequate security measures to protect consumer data, thereby driving the adoption of next generation-firewall solutions. In 2025, it is estimated that compliance-related spending will reach $1.5 billion, reflecting the growing importance of regulatory adherence. The next generation-firewall market is thus positioned to benefit from this trend, as companies seek to enhance their security frameworks to meet compliance standards and avoid potential penalties.