Rising Demand for Remote Work Solutions

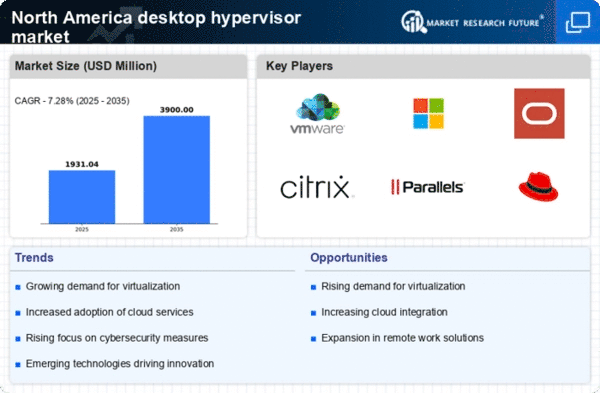

The desktop hypervisor market in North America experiences a notable surge in demand due to the increasing prevalence of remote work solutions. Organizations are increasingly adopting virtualization technologies to facilitate remote access to applications and data, thereby enhancing productivity and collaboration among distributed teams. According to recent data, the market is projected to grow at a CAGR of approximately 10% over the next five years. This trend indicates a strong inclination towards flexible work environments, which necessitate robust desktop hypervisor solutions. As businesses seek to optimize their IT infrastructure, the desktop hypervisor market is likely to benefit from this shift, as it provides essential tools for managing virtual desktops and applications efficiently.

Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver for the desktop hypervisor market in North America. Organizations are increasingly recognizing the financial benefits of virtualization, which allows for better resource allocation and reduced hardware expenditures. By consolidating multiple virtual machines on a single physical server, companies can significantly lower their operational costs. Reports suggest that businesses can save up to 30% on IT infrastructure costs by implementing desktop hypervisors. This financial incentive drives the adoption of virtualization technologies, as organizations strive to maximize their return on investment. Consequently, the desktop hypervisor market is poised for growth as more enterprises seek to leverage these cost-saving opportunities.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are increasingly becoming focal points for organizations in North America, thereby impacting the desktop hypervisor market. As businesses navigate complex regulatory landscapes, they require virtualization solutions that ensure compliance with data protection laws and industry standards. Desktop hypervisors offer features that enhance data security and governance, making them attractive to organizations seeking to mitigate compliance risks. The market is witnessing a growing trend where companies prioritize solutions that not only provide virtualization capabilities but also adhere to regulatory requirements. This focus on compliance is likely to drive the desktop hypervisor market forward, as organizations invest in technologies that support their governance objectives.

Advancements in Technology and Performance

Technological advancements play a pivotal role in shaping the desktop hypervisor market in North America. Continuous improvements in hardware capabilities, such as increased processing power and memory, enable more efficient virtualization solutions. Enhanced performance features, including faster boot times and improved resource management, contribute to a more seamless user experience. As organizations demand higher performance from their virtual environments, the desktop hypervisor market is likely to evolve in response to these technological trends. Furthermore, innovations in software development, such as better integration with existing IT systems, are expected to drive further adoption of desktop hypervisors, ensuring that they remain competitive in a rapidly changing landscape.

Growing Focus on Disaster Recovery Solutions

The increasing emphasis on disaster recovery and business continuity planning significantly influences the desktop hypervisor market in North America. Organizations are recognizing the importance of having robust backup and recovery solutions in place to mitigate risks associated with data loss and system failures. Desktop hypervisors facilitate efficient disaster recovery processes by enabling quick restoration of virtual machines and applications. This capability is particularly appealing to businesses that require minimal downtime and rapid recovery in the event of an incident. As a result, the desktop hypervisor market is likely to see heightened demand for solutions that prioritize disaster recovery, further solidifying their role in organizational resilience.