Advancements in Cloud Technology

Technological advancements play a crucial role in shaping the cloud office-services market. Innovations in cloud computing, such as enhanced data analytics, machine learning, and improved user interfaces, are driving the adoption of cloud office solutions. In North America, the integration of these technologies is expected to increase productivity by approximately 25% among users. As businesses recognize the potential of these advancements, they are more inclined to invest in cloud services that offer cutting-edge features. This trend suggests a promising future for the cloud office-services market, as organizations seek to leverage technology for improved performance and efficiency.

Increased Focus on Cost Efficiency

Cost efficiency remains a pivotal driver in the cloud office-services market. Organizations are continually seeking ways to optimize their expenditures, and cloud solutions offer a compelling alternative to traditional office setups. By leveraging cloud services, companies can significantly reduce overhead costs associated with hardware, maintenance, and software licensing. In North America, businesses have reported savings of up to 30% by transitioning to cloud-based office solutions. This financial incentive is likely to propel further investment in cloud services, as firms aim to enhance their operational efficiency while maintaining competitive advantages in a rapidly evolving market.

Rising Importance of Data Security

Data security has emerged as a critical concern within the cloud office-services market. With the increasing frequency of cyber threats, organizations are prioritizing secure cloud solutions to protect sensitive information. In North America, nearly 60% of businesses have reported investing in enhanced security measures for their cloud services. This heightened focus on security not only safeguards company data but also builds trust with clients and stakeholders. As regulatory requirements continue to evolve, the demand for compliant cloud office solutions is likely to grow, further driving the market's expansion in the coming years.

Shift Towards Sustainable Practices

Sustainability is becoming an essential driver in the cloud office-services market. Companies are increasingly recognizing the environmental impact of their operations and are seeking cloud solutions that align with their sustainability goals. In North America, a significant number of organizations are adopting cloud services to reduce their carbon footprint, as these solutions often require less energy and resources compared to traditional office setups. This shift towards sustainable practices is expected to influence purchasing decisions, with businesses prioritizing cloud providers that demonstrate a commitment to environmental responsibility. Consequently, the market is likely to see a rise in demand for eco-friendly cloud office services.

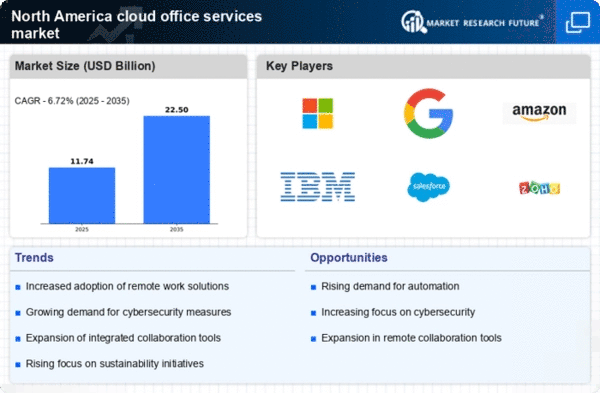

Growing Demand for Remote Work Solutions

The cloud office-services market is experiencing a notable surge in demand for remote work solutions. As organizations increasingly adopt flexible work arrangements, the need for cloud-based tools that facilitate collaboration and productivity has intensified. In North America, it is estimated that around 70% of companies have implemented remote work policies, driving the adoption of cloud office services. This shift not only enhances employee satisfaction but also reduces operational costs for businesses. The market is projected to grow at a CAGR of 15% over the next five years, indicating a robust trajectory fueled by the ongoing transformation of workplace dynamics.