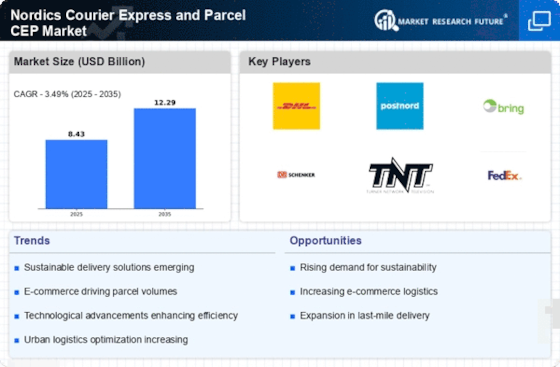

E-commerce Growth

The rapid growth of e-commerce is a major driver for the Nordics Courier Express and Parcel CEP Market. With an increasing number of consumers opting for online shopping, the demand for efficient and reliable delivery services has surged. Data shows that e-commerce sales in the Nordics have grown by over 30% in the past year alone, prompting courier services to adapt their operations accordingly. This growth necessitates the expansion of logistics networks and the enhancement of last-mile delivery solutions. As a result, companies are likely to invest in technology and infrastructure to meet the rising expectations of consumers for faster and more convenient delivery options.

Urbanization Trends

Urbanization trends are significantly impacting the Nordics Courier Express and Parcel CEP Market. As more people migrate to urban areas, the demand for efficient delivery services in densely populated regions increases. This urban shift creates unique challenges for logistics providers, such as navigating traffic congestion and limited delivery windows. Recent studies indicate that urban areas in the Nordics are expected to grow by 15% over the next decade, which could lead to a surge in demand for innovative delivery solutions. Companies are likely to explore options such as micro-fulfillment centers and alternative delivery methods to address these challenges, thereby enhancing their service offerings in urban environments.

Regulatory Compliance

Regulatory compliance is a critical driver in the Nordics Courier Express and Parcel CEP Market. The region is known for its stringent regulations regarding data protection, environmental standards, and labor laws. Companies operating in this market must navigate these regulations to avoid penalties and maintain their reputations. For instance, the General Data Protection Regulation (GDPR) has significant implications for how courier services handle customer data. Compliance with such regulations not only ensures legal adherence but also builds consumer trust. As regulatory frameworks continue to evolve, companies are likely to invest in compliance strategies and technologies, which could influence operational costs and service delivery in the industry.

Technological Integration

Technological integration plays a pivotal role in shaping the Nordics Courier Express and Parcel CEP Market. The adoption of advanced technologies such as artificial intelligence, machine learning, and automation is transforming logistics operations. These technologies enable companies to enhance efficiency, reduce costs, and improve customer service. For example, AI-driven analytics can optimize delivery routes, leading to faster and more reliable service. Recent statistics indicate that around 45% of logistics companies in the Nordics have implemented some form of automation in their operations. This trend suggests that as technology continues to evolve, the industry will likely experience significant advancements in operational capabilities, ultimately benefiting consumers through improved service offerings.

Sustainability Initiatives

The Nordics Courier Express and Parcel CEP Market is increasingly influenced by sustainability initiatives. Companies are adopting eco-friendly practices to reduce their carbon footprints, which resonates with the environmentally conscious consumers in the region. For instance, many courier services are investing in electric vehicles and optimizing delivery routes to minimize emissions. According to recent data, approximately 60% of consumers in the Nordics prefer companies that demonstrate a commitment to sustainability. This trend not only enhances brand loyalty but also aligns with governmental policies aimed at reducing greenhouse gas emissions. As a result, the industry is likely to see a shift towards greener logistics solutions, which could redefine operational strategies and customer engagement in the coming years.