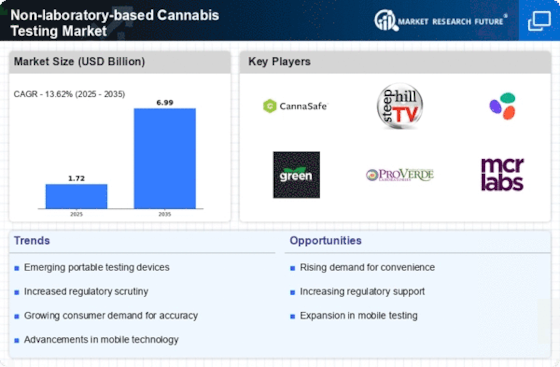

Consumer Demand for Quick Results

In the Non-laboratory-based Cannabis Testing Market, there is a growing consumer demand for quick and reliable testing results. As cannabis products become more mainstream, consumers are increasingly concerned about product safety and quality. Non-laboratory testing methods, which provide immediate feedback on cannabinoid content and contaminants, are appealing to consumers who prioritize transparency and rapid results. Market data indicates that approximately 60% of consumers prefer products that offer on-site testing options. This trend suggests that businesses that adopt non-laboratory testing solutions may gain a competitive edge by catering to the evolving preferences of informed consumers.

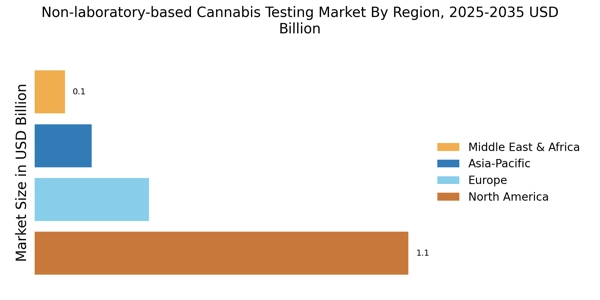

Regulatory Support and Compliance

The Non-laboratory-based Cannabis Testing Market is influenced by evolving regulatory frameworks that support the use of non-laboratory testing methods. Governments are increasingly recognizing the need for rapid testing solutions to ensure product safety and compliance with health standards. As regulations become more favorable, businesses are likely to adopt non-laboratory testing methods to meet compliance requirements efficiently. This shift is evidenced by recent legislative changes in various regions that promote the use of portable testing technologies. The potential for reduced regulatory burdens may encourage more companies to enter the market, thereby expanding the overall industry.

Increased Focus on Health and Safety

The Non-laboratory-based Cannabis Testing Market is witnessing an increased focus on health and safety, which is driving demand for effective testing solutions. As public awareness of cannabis-related health issues rises, consumers and regulators alike are emphasizing the importance of product safety. Non-laboratory testing methods provide a means to quickly assess the safety and quality of cannabis products, addressing consumer concerns. This heightened focus on health and safety is reflected in market trends, with a notable increase in the number of companies investing in non-laboratory testing technologies. The potential for improved consumer trust and product integrity may further stimulate growth in this sector.

Cost-Effectiveness of Non-Laboratory Testing

The Non-laboratory-based Cannabis Testing Market is benefiting from the cost-effectiveness associated with non-laboratory testing methods. Traditional laboratory testing can be prohibitively expensive and time-consuming, often leading to delays in product release. In contrast, non-laboratory testing solutions offer a more affordable alternative, enabling businesses to conduct tests without incurring high laboratory fees. This cost advantage is particularly appealing to small and medium-sized enterprises that may lack the resources for extensive laboratory testing. As the market continues to expand, the affordability of non-laboratory testing methods is likely to drive adoption rates, further propelling industry growth.

Technological Innovations in Testing Devices

The Non-laboratory-based Cannabis Testing Market is experiencing a surge in technological innovations that enhance the accuracy and efficiency of testing devices. Portable testing kits, which utilize advanced sensors and algorithms, are becoming increasingly popular among consumers and businesses alike. These devices allow for on-site testing, providing immediate results that are crucial for both compliance and consumer safety. The market for portable testing devices is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This trend indicates a shift towards more accessible testing solutions, which could potentially reshape the landscape of cannabis quality assurance.