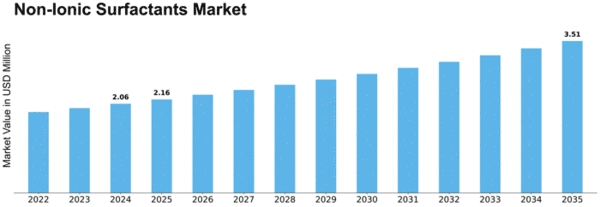

Non Ionic Surfactants Size

Non-Ionic Surfactants Market Growth Projections and Opportunities

The market for non-ionic surfactants is shaped by various factors that influence its growth and dynamics. One significant market factor is the growing demand across diverse industries such as personal care, household cleaning, agriculture, and industrial applications. Non-ionic surfactants, known for their versatility and compatibility with different formulations, are increasingly preferred by manufacturers for their ability to enhance product performance and stability. The rising awareness among consumers regarding the benefits of non-ionic surfactants, such as their mildness and low irritancy, further drives their demand in personal care and cleaning products.

Regulatory factors also play a crucial role in the non-ionic surfactants market. Government regulations aimed at environmental protection and safety standards often dictate the use of surfactants with specific characteristics, such as biodegradability and low toxicity. This has led to the development of eco-friendly and sustainable non-ionic surfactants that comply with stringent regulatory requirements. Manufacturers are increasingly focusing on innovating formulations that meet these regulatory standards while maintaining performance efficacy, thereby driving market growth.

Technological advancements in surfactant chemistry contribute significantly to the evolution of the non-ionic surfactants market. Continuous research and development efforts have led to the discovery of novel surfactant molecules with improved properties, such as enhanced emulsification, foam stabilization, and solubility. These advancements enable manufacturers to develop tailored solutions for diverse applications, expanding the potential market for non-ionic surfactants across various industries.

Moreover, market dynamics are influenced by the economic landscape, including factors such as raw material availability, pricing, and supply chain logistics. Fluctuations in the prices of raw materials, such as ethylene oxide and fatty alcohols, directly impact the production costs of non-ionic surfactants. Manufacturers often face challenges in maintaining profitability amidst volatile raw material prices, leading to strategic sourcing initiatives and supply chain optimization efforts to mitigate risks and ensure cost competitiveness.

Consumer preferences and trends also drive market demand for non-ionic surfactants. The growing demand for eco-friendly and natural products has led to a shift towards bio-based and renewable surfactants derived from sources such as plant oils and sugars. Non-ionic surfactants derived from renewable feedstocks offer a sustainable alternative to petrochemical-based surfactants, aligning with the preferences of environmentally conscious consumers and driving market growth in this segment.

Furthermore, competitive dynamics shape the non-ionic surfactants market, with key players focusing on strategies such as product innovation, mergers and acquisitions, and partnerships to gain a competitive edge. The presence of established players with extensive product portfolios and global distribution networks intensifies competition in the market. Emerging players often focus on niche segments or innovative formulations to differentiate themselves and capture market share in the highly competitive landscape.

Leave a Comment