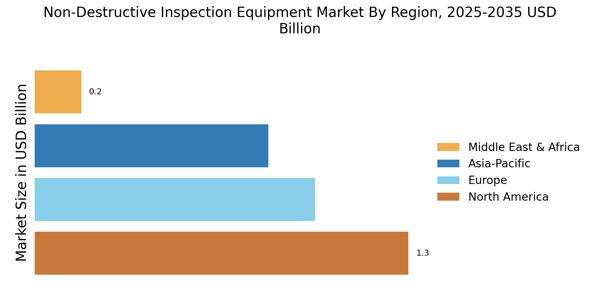

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American non-destructive inspection equipment market accounted for USD 1.28 billion in 2022 and will likely exhibit a significant CAGR growth in the study period. The region dominates due to increased demand for advanced material testing from the United States, Canada, and Mexico. In the United States, established industry players such as Acuren Inspection Inc, Fischer Technology Inc, and Magnaflux Corporation drive the market.

These end users are primarily from the transportation, manufacturing, aviation, oil & gas, maritime, and power generation industries. According to the Federal Aviation Administration (FAA), over 200,000 airplanes in the United States undergo yearly periodic safety inspections using non-destructive testing equipment. In addition, the U.S. government is increasing its investments in oil & natural gas to support the establishment of the biotech supercluster.

Also, the major countries studied in the market report are the U.S., German, Canada, the UK, France, Italy, Japan, China, Spain, Australia, India, South Korea, and Brazil.

Figure 2: Non-Destructive Inspection Equipment Market SHARE BY REGION 2022 (%)

The European non-destructive inspection equipment market accounts for the second-largest global market share. In European industries, stringent rules and standards about quality, safety, and performance criteria drive the adoption of non-destructive inspection technology to comply with these regulations.

In addition, technological advancements such as improved imaging techniques, robots, and artificial intelligence (AI) applications are improving the capabilities and accuracy of non-destructive inspection equipment, boosting their use in multiple sectors across Europe. Further, the German non-destructive inspection equipment market held the largest market share, and the UK non-destructive inspection equipment market was the fastest growing market in the European region.

The Asia-Pacific Non-Destructive Inspection Equipment Market is expected to grow at the fastest CAGR from 2023 to 2032. Rapid urbanization and industrialization in India and China are boosting demand for nondestructive inspection equipment in the manufacturing, automotive, aerospace, and infrastructure construction industries.

Increased expenditures in infrastructure development projects in the region, such as railways, bridges, and power plants, are increasing the demand for nondestructive inspection technology to maintain the efficacy and safety of these essential facilities. Moreover, China’s non-destructive inspection equipment market held the largest market share, and the Indian non-destructive inspection equipment market was the fastest-growing market in the Asia-Pacific region.