Market Share

Nisin Market Share Analysis

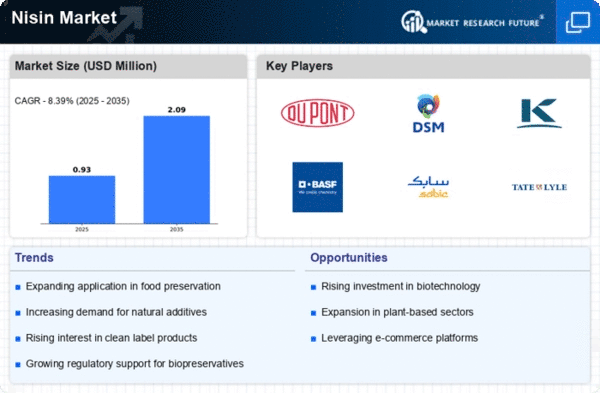

The Nisin market, a key player in the food preservatives industry, employs various market share positioning strategies to maintain and enhance its competitive edge. Market share is a crucial metric that reflects a company's portion of total sales within a specific industry. In the context of the Nisin market, several strategies are employed to solidify and expand this market share.

Product differentiation is another major strategy. Nisin producers are gaining great success in that they design distinct and superior products that cannot be found elsewhere. Such will relate to funding in a research and development program to maximize the effectiveness of Nisin as a preservative in the face of the food sector demands changes. A better quality product will help these businesses reach a broader customer base and be a consumer favorite compared to competing companies.

Another cruuciall area in market share positioning for the Nisin industry is called pricing strategies. Companies could use different pricing strategies, for instance, cost-based pricing or price based on value positioning to set competitive prices of their goods. Cheapening quality and therefore decreasing its perceived worth is not only a potential downside of affordable products, but it also might be the reason why this kind of products do not appeal to the majority. Besides pricing for people with different income and bulk purchases bonuses are good for winning over a bigger market share and inciting customers to be loyal.

Channels of distribution can't be overlooked, as they present the determining position in market share presence. Trying to achieve efficiency and ubiquity is a real guarantee somebody will get access to them. Companies may consider a go-to-market strategy where they either dive into distribution channels or open up their own retail store to expand their market. This approach is useful in terms of finding the new marketplaces and acquiring a larger share of the market by making the product available for larger number of consumers.

Marketing and branding efforts play one of the most comprehensive parts of positioning strategies in a market share whose primary characteristic is personality and individualism. Promotion of the brand through various avenues e.g. social media, industries events, and traditional advertising is an insightful approach of building the awareness and brand recognition. Illustrating Nisin's discriminatory advantages in terms of quality, safety and impact on the market could be the difference between the consumer to prefer to your products and bring higher market share. Creating a strong brand image is as much as the main ingredient in long-term success in a competitive market as the ingredients themselves.

The chemical-free Nisin route even called for continuous innovation to keep its market share. Firms put in extensive research and development tasks to beat the competition that comes from the rival companies and to keep in line with the consumer demands and industrial trends. The release of updated and better Nisin variant versions shall ensure the brand remains topical and relevant, thereby attracting both the existing and prospective buyers who in turn will cement the current market share.

Monitoring market and regulatory trends along with their quick changes has always been important for successful market share positioning strategies. Knowing what the consumers’ preferences change to, what kind of standards are in the industry and the regulatory authorities is one aspect that allows companies in the Nisin Market to be proactive and plan ahead; their adjustments will be based on the fact that they are compliant and the favored market position.

Leave a Comment