Government Initiatives and Funding

The Next Generation Sequencing Market is bolstered by various government initiatives and funding programs aimed at advancing genomic research. Governments are increasingly recognizing the importance of genomics in healthcare and are investing in initiatives that promote the development and application of sequencing technologies. For example, funding for large-scale genomic projects and biobanks is becoming more prevalent, facilitating access to genomic data for research purposes. This financial support is likely to accelerate innovation within the next generation sequencing market, as it enables researchers to explore new applications and improve existing technologies. Additionally, public-private partnerships are emerging, further enhancing the collaborative environment necessary for advancing sequencing capabilities. As these initiatives continue to grow, they are expected to play a crucial role in shaping the future landscape of the next generation sequencing market.

Rising Demand for Personalized Medicine

The Next Generation Sequencing Market is significantly influenced by the increasing demand for personalized medicine. As healthcare shifts towards tailored treatment approaches, the ability to sequence an individual's genome becomes paramount. This trend is evident in oncology, where genomic profiling is utilized to identify specific mutations and inform targeted therapies. The market for personalized medicine is projected to reach substantial figures, with estimates suggesting it could exceed several billion dollars by the end of the decade. This growing emphasis on individualized treatment plans is likely to drive the adoption of next generation sequencing technologies, as they provide critical insights into genetic variations that influence patient responses to therapies. Consequently, the integration of sequencing into clinical practice is expected to enhance patient outcomes and optimize healthcare resources.

Increasing Prevalence of Genetic Disorders

The Next Generation Sequencing Market is significantly impacted by the increasing prevalence of genetic disorders worldwide. As the understanding of genetic conditions expands, there is a growing need for effective diagnostic tools that can identify these disorders at an early stage. Next generation sequencing technologies offer a comprehensive approach to genetic testing, allowing for the detection of multiple genetic mutations simultaneously. This capability is particularly valuable in the context of rare diseases, where traditional diagnostic methods may fall short. The market is projected to see substantial growth as healthcare providers increasingly adopt sequencing technologies to enhance diagnostic accuracy and improve patient management. Furthermore, the rising awareness of genetic testing among patients is likely to drive demand, positioning next generation sequencing as a vital component in the landscape of modern healthcare.

Technological Advancements in Sequencing Technologies

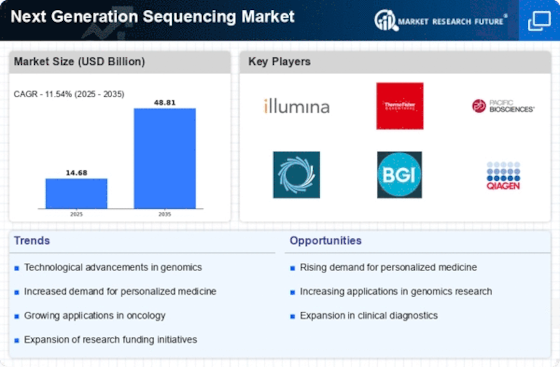

The Next Generation Sequencing Market is experiencing rapid technological advancements that enhance sequencing capabilities. Innovations such as improved sequencing platforms and bioinformatics tools are driving efficiency and accuracy. For instance, the introduction of single-cell sequencing technologies allows for the analysis of individual cells, providing insights into cellular heterogeneity. This advancement is expected to propel the market, with projections indicating a compound annual growth rate of over 20% in the coming years. Furthermore, advancements in data analysis software are streamlining the interpretation of complex genomic data, making it more accessible to researchers and clinicians alike. As these technologies evolve, they are likely to expand the applications of next generation sequencing, thereby increasing its adoption across various sectors.

Expansion of Applications in Research and Clinical Settings

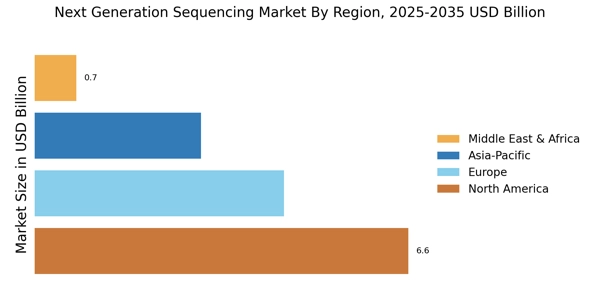

The Next Generation Sequencing Market is witnessing an expansion of applications across both research and clinical settings. In research, next generation sequencing is being utilized for various purposes, including genomics, transcriptomics, and epigenomics, thereby broadening its utility. Clinical applications are also on the rise, particularly in areas such as infectious disease diagnostics and genetic disorder screening. The market is projected to grow as more healthcare institutions adopt sequencing technologies for routine diagnostics. Reports indicate that the clinical segment could account for a significant share of the market, driven by the need for rapid and accurate diagnostic tools. This expansion not only enhances the capabilities of healthcare providers but also fosters collaboration between academic institutions and industry, further propelling the growth of the next generation sequencing market.