Market Analysis

In-depth Analysis of Next Generation Computing Market Industry Landscape

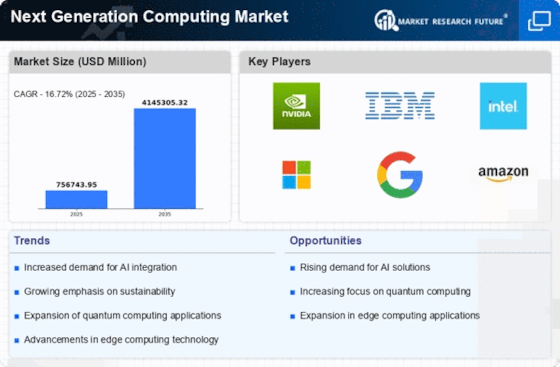

The next generation computing market is driven by a multitude of factors that shape its trajectory and growth. One of the primary market factors is technological advancement. As computing technology evolves, with breakthroughs in areas such as quantum computing, artificial intelligence, and edge computing, there's a constant demand for newer, faster, and more efficient systems. This drive for innovation fuels investment in research and development, leading to the creation of cutting-edge solutions that cater to evolving consumer needs and preferences.

Moreover, the increasing demand for computational power across various industries is another significant market factor. Industries such as healthcare, finance, automotive, and entertainment require powerful computing systems to process massive amounts of data and perform complex tasks. This demand acts as a catalyst for the growth of the next generation computing market, as companies strive to meet the requirements of these sectors by offering specialized solutions tailored to their needs.

Furthermore, the rise of cloud computing and the proliferation of connected devices contribute to the expansion of the next generation computing market. With the advent of cloud technology, businesses can access vast computational resources on-demand, enabling them to scale their operations more efficiently and cost-effectively. Additionally, the increasing number of connected devices, fueled by the Internet of Things (IoT) revolution, generates massive amounts of data that need to be processed and analyzed in real-time, driving the demand for advanced computing solutions.

Another crucial market factor is the growing focus on sustainability and energy efficiency. As concerns about environmental impact and energy consumption rise, there's a growing emphasis on developing computing systems that are not only powerful but also environmentally friendly. This has led to the emergence of energy-efficient architectures and technologies, such as low-power processors and renewable energy-powered data centers, which appeal to environmentally conscious consumers and businesses alike.

Additionally, regulatory factors play a significant role in shaping the next generation computing market. Government policies and regulations concerning data privacy, cybersecurity, and intellectual property rights have a profound impact on the development and adoption of new computing technologies. Compliance with these regulations is essential for companies operating in the next generation computing market, as non-compliance can result in fines, legal action, and damage to reputation.

Furthermore, market dynamics such as competition and consumer behavior influence the evolution of the next generation computing market. Competition among technology companies drives innovation and pushes them to continuously improve their products and services to gain a competitive edge. Meanwhile, consumer preferences and purchasing behavior dictate the demand for different types of computing devices and technologies, shaping the direction of market development.

Leave a Comment