Integration of IoT Devices

The integration of Internet of Things (IoT) devices is significantly influencing the Network Telemetry Market. As more devices become interconnected, the volume of telemetry data generated is expected to increase exponentially. This influx of data necessitates advanced telemetry solutions capable of managing and analyzing vast amounts of information. Industry reports suggest that the number of connected IoT devices could reach over 75 billion by 2025, creating a substantial demand for effective network telemetry solutions. Organizations are compelled to adopt telemetry technologies that can handle this complexity, ensuring seamless communication and data flow across devices. Consequently, the Network Telemetry Market is poised for growth as businesses seek to harness the potential of IoT through enhanced telemetry capabilities.

Advancements in Network Infrastructure

Advancements in network infrastructure are significantly shaping the Network Telemetry Market. The transition to high-speed networks, such as 5G, is facilitating the collection and analysis of telemetry data at unprecedented speeds. This evolution allows organizations to gain deeper insights into network performance and user behavior. Industry analysts predict that the global rollout of 5G technology will enhance data transmission capabilities, thereby increasing the demand for sophisticated telemetry solutions. As organizations upgrade their infrastructure to support these advancements, the need for effective telemetry tools becomes paramount. Consequently, the Network Telemetry Market is likely to benefit from these technological improvements, as businesses seek to optimize their network operations and enhance user experiences.

Growing Importance of Network Security

In the current landscape, the growing importance of network security is a critical driver for the Network Telemetry Market. With cyber threats becoming increasingly sophisticated, organizations are prioritizing the implementation of robust security measures. Network telemetry plays a vital role in identifying vulnerabilities and monitoring network traffic for suspicious activities. Recent statistics indicate that cybercrime costs are projected to reach trillions of dollars annually, underscoring the urgency for effective security solutions. As a result, businesses are investing in telemetry technologies that provide comprehensive visibility into network operations, enabling proactive threat detection and response. This heightened focus on security is likely to propel the Network Telemetry Market forward, as organizations seek to safeguard their digital assets.

Regulatory Compliance and Data Governance

Regulatory compliance and data governance are emerging as significant drivers within the Network Telemetry Market. Organizations are increasingly required to adhere to stringent regulations regarding data privacy and security. Telemetry solutions provide essential capabilities for monitoring compliance and ensuring that data handling practices align with regulatory standards. Recent surveys indicate that a substantial percentage of organizations view compliance as a top priority, leading to increased investments in telemetry technologies. This trend is expected to continue as regulations evolve and become more complex. As a result, the Network Telemetry Market is likely to see a rise in demand for solutions that facilitate compliance monitoring and data governance, enabling organizations to navigate the regulatory landscape effectively.

Rising Demand for Real-Time Data Analysis

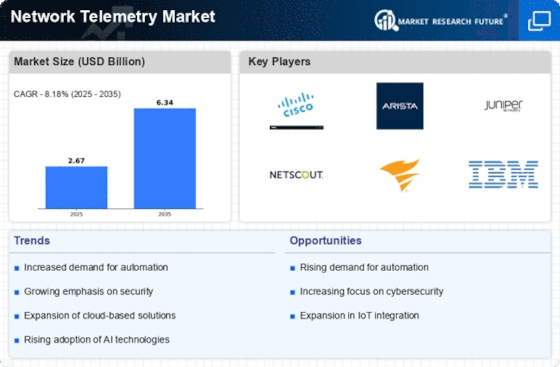

The Network Telemetry Market is experiencing a notable surge in demand for real-time data analysis. Organizations are increasingly recognizing the value of immediate insights derived from network data, which can enhance decision-making processes. This trend is driven by the need for improved operational efficiency and the ability to respond swiftly to network anomalies. According to recent estimates, the market for real-time analytics is projected to grow at a compound annual growth rate of approximately 30% over the next five years. This growth is indicative of a broader shift towards data-driven strategies, where organizations leverage telemetry data to optimize performance and mitigate risks. As a result, the Network Telemetry Market is likely to see a proliferation of solutions that facilitate real-time monitoring and analysis.