Top Industry Leaders in the Network Security Appliance Market

A Competitive Landscape of the Network Security Appliance Market:

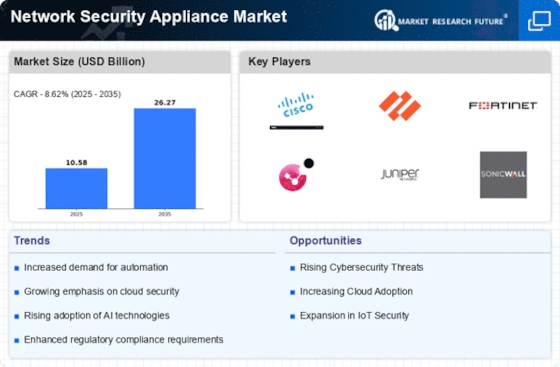

The network security appliance market, a multi-billion dollar landscape, is in a state of constant flux, driven by evolving threats, shifting customer demands, and an ever-growing pool of players. Understanding the competitive dynamics of this market is crucial for both established vendors and aspiring entrants. This analysis delves into the key players, their adopted strategies, factors influencing market share, and the emergence of new forces shaping the future of this vital security domain.

Key Players:

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Fortinet Inc.

- Check Point Software Technologies Ltd.

- Symantec Corporation

- Sophos Ltd.,

- Juniper Networks Inc.

- Forcepoint LLC

- Barracuda Networks

Strategies Adopted by Key Players:

- Cisco: The undisputed leader, Cisco leverages its massive network infrastructure footprint and brand recognition to offer a comprehensive suite of security appliances. Their focus on integration with existing Cisco solutions and cloud-based security offerings keeps them at the forefront.

- Fortinet: Renowned for their high-performance and feature-rich appliances, Fortinet emphasizes scalability and unified threat management (UTM) capabilities. Their aggressive marketing and partner-driven approach have secured them a strong position in the mid-market and enterprise segments.

- Palo Alto Networks: A pioneer in next-generation firewalls, Palo Alto Networks stands out for its innovative approach to security. Their focus on application-centric security and advanced threat detection techniques has garnered them a loyal following in security-conscious organizations.

Factors Shaping Market Share:

- Technology Differentiation: The ability to offer cutting-edge features, such as AI-powered threat detection, cloud-based sandboxing, and advanced encryption, is a key differentiator. Companies that invest in R&D and stay ahead of the curve in terms of technology are likely to gain market share.

- Pricing and Deployment Models: Offering flexible pricing models, including subscription-based services and pay-as-you-go options, can attract cost-conscious customers. Additionally, simplifying deployment and management through cloud-based solutions can be a significant advantage.

- Target Market Focus: Understanding and catering to specific market segments, such as small and medium businesses (SMBs), large enterprises, or specific industry verticals, with tailored solutions and pricing can be a winning strategy.

- Partnerships and Acquisitions: Strategic partnerships with technology providers and channel partners can expand reach and market share. Additionally, targeted acquisitions of niche players with complementary technologies can bolster capabilities and offerings.

New and Emerging Players:

- Cloud-Native Security Vendors: Companies like Zscaler and Netskope are challenging the traditional appliance model with cloud-based security solutions. Their subscription-based approach and ease of deployment are finding favor with organizations adopting cloud-based infrastructure.

- Open-Source Security Solutions: Open-source projects like pfSense and OPNSense are gaining traction in cost-sensitive environments. While they require more technical expertise to manage, their flexibility and affordability are appealing to certain segments.

- Specialized Security Appliances: Companies like Palo Alto Networks and McAfee are offering appliances focused on specific security needs, such as web filtering or data loss prevention. This targeted approach caters to specific customer requirements and can be a lucrative niche.

Industry Developments

Cisco Systems:

- October 26, 2023: Announced Cloud Native Security (CNS) portfolio, including next-generation firewalls, SecureX cloud platform, and identity and access management solutions.

- November 15, 2023: Unveiled Cisco Extended Security Response (ESR), a managed security service offering threat detection, investigation, and response.

- December 12, 2023: Acquired ThousandEyes, a network visibility and intelligence company, to enhance network security monitoring and incident response.

Palo Alto Networks:

- September 27, 2023: Launched Prisma Cloud 4.0, offering deeper cloud security posture management and workload protection.

- October 19, 2023: Announced Cortex XDR 3.2, featuring improved threat detection and incident response capabilities.

- December 6, 2023: Partnered with Google Cloud to deliver managed Palo Alto Networks security solutions on Google Cloud Platform.