Top Industry Leaders in the Network-Attached Storage Market

Competitive Landscape of the Network Attached Storage Market:

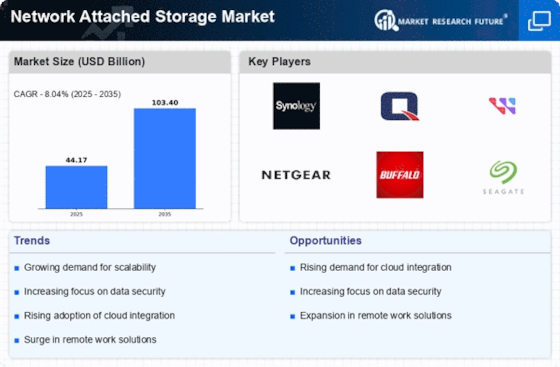

The Network Attached Storage (NAS) market is experiencing significant growth, driven by factors such as increasing data volumes, the proliferation of connected devices, and the growing popularity of cloud-based services. This has attracted a diverse range of players, resulting in a dynamic and competitive landscape.

Key Players:

- Space Monkey (US)

- Buffalo Americas Inc. (Japan)

- Synology Inc. (Taiwan)

- QNAP Systems Inc. (Taiwan)

- Netgear Inc. (US)

- Western Digital Corp. (US)

- Cisco Systems Inc. (US)

- Seagate Technology Public Limited Company (Ireland)

- Netapp Inc. (US)

- Hitachi Vantara Corporation (US)

- IBM Corporation (US)

- HPE (US)

- Dell EMC (US)

Strategies Adopted by Key Players:

- Product Differentiation: Companies are focusing on developing unique product features and functionalities to cater to specific needs of different market segments.

- Strategic Partnerships: Collaborations with other technology companies are enabling NAS vendors to offer broader solutions and reach new customer segments.

- Channel Expansion: Many companies are expanding their distribution channels to reach a wider range of customers through online and offline channels.

- Technological Innovation: Companies are investing in research and development to incorporate cutting-edge technologies like AI, cloud integration, and high-speed connectivity into their NAS solutions.

- Focus on User Experience: Companies are placing increasing emphasis on user-friendly interfaces, mobile apps, and intuitive management tools to improve user experience.

Factors for Market Share Analysis:

- Product Portfolio: Breadth and depth of product offerings across various segments like consumer, small and medium businesses (SMB), and enterprise.

- Brand Reputation: Recognition and trust associated with the brand name.

- Technology Leadership: Innovation and advanced technology incorporated into NAS solutions.

- Channel Coverage: Reach and effectiveness of distribution channels through online and offline platforms.

- Marketing and Sales Strategies: Effectiveness of marketing campaigns and sales strategies in reaching target customers.

New and Emerging Companies:

Several new companies are entering the NAS market, offering innovative solutions and challenging the established players. Some examples include:

- Minix: Offering affordable and compact NAS solutions for home users.

- QHora: Specializing in high-performance NAS solutions for demanding workloads.

- IOGEAR: Providing NAS solutions with built-in backup and media streaming features.

- D-Link: Expanding its networking expertise into the NAS market.

- QNAP Systems: Offering cloud-based NAS solutions for a hybrid storage environment.

Current Company Investment Trends:

- Cloud Integration: Companies are integrating their NAS solutions with cloud services for data backup, remote access, and disaster recovery.

- AI and Machine Learning: AI is being used to enhance data management, security features, and user experience.

- Security Features: Advanced security features are being incorporated to address growing concerns about data privacy and cyberattacks.

- Scalability and Performance: Companies are focusing on developing highly scalable and performant NAS solutions for demanding workloads.

- Sustainability: Some companies are exploring sustainable materials and manufacturing practices for their NAS solutions.

Latest Company Updates:

The OceanStor Pacific 9920, a network-attached storage (NAS) array from Huawei, will be available in Europe in 2023 and have a raw capacity of up to 92TB in 2U of rack space. With this action, Huawei circumvents the equipment operator market constraints that it faces, particularly those imposed by the European Union, and targets datacenters.

The first Thunderbolt 4 Network Attached Storage (NAS) was unveiled by QNAP in 2023, and it is expected to completely change how creative professionals work on media projects. The TVS-h674T and TVS-h874T models are made specifically for video production companies and creators. They are intended to boost output dramatically and protect creative works. The announcement coincides with QNAP's Thunderbolt 4 NAS's release in Australia and New Zealand.

2023 will see an increase in the sophistication of malware assaults, and as more and more business operations shift to the cloud, organisations will need to strengthen their defences. They can with SentinelOne. The first two products in the Cloud Data Security product line, Threat Detection for Amazon S3 and Threat Detection for NetApp, are now generally available. The company is a global pioneer in autonomous cybersecurity.