Rising Energy Costs

The escalating costs of energy are a primary driver for the Net Zero Energy Buildings Market. As energy prices continue to rise, both consumers and businesses are increasingly motivated to seek solutions that minimize energy consumption and enhance efficiency. This trend is evident in various regions, where energy costs have surged by over 30% in the last decade. Consequently, the demand for net zero energy buildings, which produce as much energy as they consume, is likely to increase. These buildings not only reduce energy bills but also provide a hedge against future energy price volatility. The Net Zero Energy Buildings Market is thus positioned to benefit from this economic pressure, as stakeholders recognize the long-term financial advantages of investing in energy-efficient infrastructure.

Technological Innovations

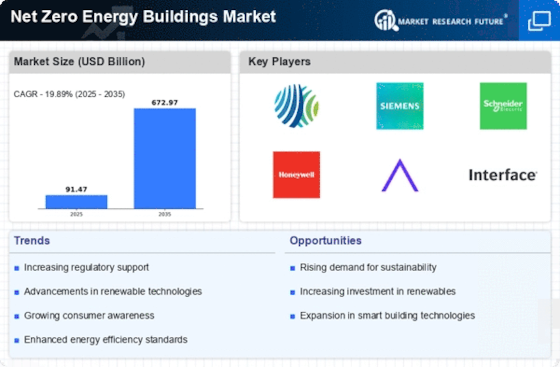

Technological innovations are transforming the Net Zero Energy Buildings Market by enhancing energy efficiency and sustainability. Advancements in building materials, such as high-performance insulation and energy-efficient windows, contribute to reduced energy consumption. Moreover, the integration of smart technologies, including energy management systems and IoT devices, allows for real-time monitoring and optimization of energy use. The market for smart building technologies is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. These innovations not only improve the performance of net zero energy buildings but also make them more appealing to consumers and investors alike. As technology continues to evolve, the Net Zero Energy Buildings Market is likely to expand, driven by the demand for smarter, more efficient buildings.

Increased Environmental Awareness

The growing awareness of environmental issues is a significant driver for the Net Zero Energy Buildings Market. As climate change and sustainability become pressing global concerns, consumers and businesses are increasingly prioritizing eco-friendly practices. This shift in mindset is reflected in the rising demand for buildings that minimize carbon footprints and utilize renewable energy sources. Research indicates that a substantial percentage of consumers are willing to pay a premium for sustainable buildings, which further fuels market growth. Additionally, organizations are adopting corporate social responsibility initiatives that emphasize sustainability, leading to increased investments in net zero energy buildings. The Net Zero Energy Buildings Market stands to gain from this heightened environmental consciousness, as stakeholders seek to align their practices with sustainable development goals.

Government Incentives and Policies

Government incentives and policies play a crucial role in propelling the Net Zero Energy Buildings Market. Numerous countries have implemented tax credits, rebates, and grants to encourage the construction and retrofitting of energy-efficient buildings. For instance, some regions offer up to 30% tax credits for renewable energy installations, which significantly lowers the initial investment barrier. Additionally, stringent building codes and standards are being enforced, mandating energy efficiency in new constructions. This regulatory landscape not only fosters innovation but also creates a favorable environment for the adoption of net zero energy buildings. As governments continue to prioritize sustainability, the Net Zero Energy Buildings Market is expected to experience robust growth driven by these supportive measures.

Urbanization and Population Growth

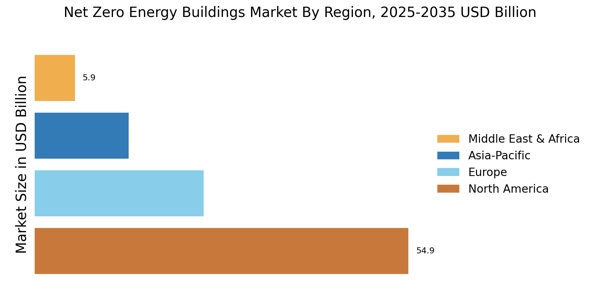

Urbanization and population growth are driving forces behind the Net Zero Energy Buildings Market. As more individuals migrate to urban areas, the demand for housing and commercial spaces intensifies. This trend necessitates the development of energy-efficient buildings that can accommodate growing populations while minimizing environmental impact. Projections indicate that urban areas will house nearly 70% of the global population by 2050, creating a pressing need for sustainable infrastructure. Net zero energy buildings offer a viable solution to this challenge, as they can effectively meet energy demands without exacerbating resource depletion. Consequently, the Net Zero Energy Buildings Market is likely to thrive as urban planners and developers increasingly recognize the importance of integrating sustainability into urban development strategies.