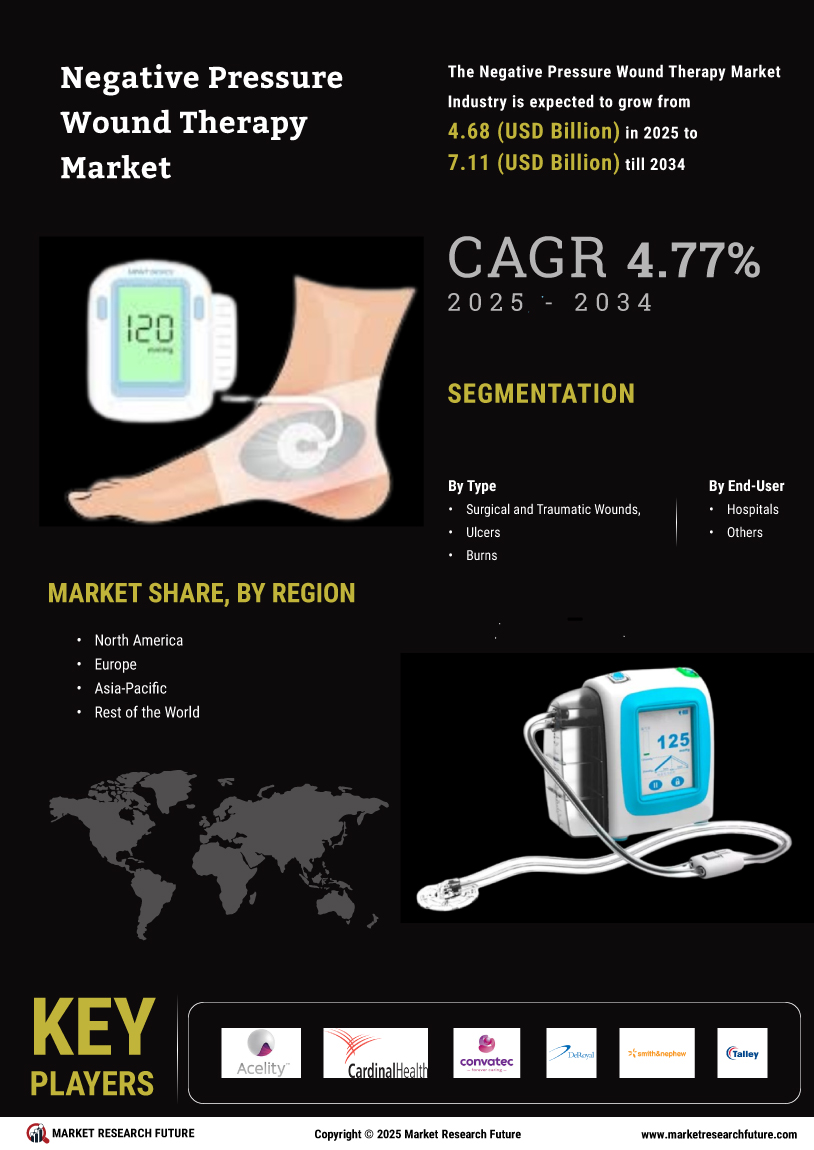

Market Growth Projections

The Global Negative Pressure Wound Therapy Market Industry is poised for substantial growth, with projections indicating a market size of 3.73 USD Billion in 2024 and a potential increase to 7 USD Billion by 2035. The anticipated CAGR of 5.89% from 2025 to 2035 underscores the increasing adoption of negative pressure wound therapy across various healthcare settings. This growth trajectory reflects the ongoing advancements in technology, rising awareness of wound care, and the expanding geriatric population, all of which are likely to shape the future landscape of the wound care market.

Rising Geriatric Population

The increasing geriatric population globally is a significant driver for the Global Negative Pressure Wound Therapy Market Industry. Older adults are more susceptible to chronic wounds due to factors such as decreased mobility, comorbidities, and skin fragility. As the global population ages, the demand for effective wound care solutions is likely to rise. This demographic shift is expected to contribute to the market's growth, with projections indicating a potential market size of 7 USD Billion by 2035. The healthcare sector must adapt to meet the needs of this population, further enhancing the relevance of negative pressure wound therapy.

Increasing Healthcare Expenditure

The rise in global healthcare expenditure is a crucial factor driving the Global Negative Pressure Wound Therapy Market Industry. Governments and private sectors are investing more in healthcare infrastructure, leading to improved access to advanced wound care treatments. This trend is particularly evident in developed regions, where healthcare budgets are expanding to accommodate innovative therapies. As a result, the market is projected to grow at a CAGR of 5.89% from 2025 to 2035, reflecting the increasing prioritization of effective wound management solutions in healthcare policies.

Rising Incidence of Chronic Wounds

The increasing prevalence of chronic wounds, such as diabetic ulcers and pressure sores, is a primary driver for the Global Negative Pressure Wound Therapy Market Industry. According to health statistics, chronic wounds affect millions globally, leading to prolonged treatment durations and higher healthcare costs. In 2024, the market is projected to reach 3.73 USD Billion, reflecting the urgent need for effective wound management solutions. As the global population ages and the incidence of diabetes rises, the demand for advanced therapies like negative pressure wound therapy is likely to grow, further propelling market expansion.

Growing Awareness of Advanced Wound Care

There is a growing awareness among healthcare professionals and patients regarding the benefits of advanced wound care solutions, including negative pressure wound therapy. Educational initiatives and training programs are enhancing knowledge about the effectiveness of these therapies in promoting faster healing and reducing complications. This heightened awareness is likely to drive demand within the Global Negative Pressure Wound Therapy Market Industry, as more healthcare providers incorporate these methods into their treatment protocols. As awareness continues to spread, the market is expected to experience robust growth in the coming years.

Technological Advancements in Wound Care

Innovations in wound care technology are significantly influencing the Global Negative Pressure Wound Therapy Market Industry. The development of portable and user-friendly negative pressure devices enhances patient compliance and facilitates at-home care. These advancements not only improve healing rates but also reduce hospital stays and associated costs. As healthcare providers increasingly adopt these technologies, the market is expected to witness substantial growth. By 2035, the market could potentially reach 7 USD Billion, driven by ongoing research and development efforts aimed at optimizing wound healing processes.