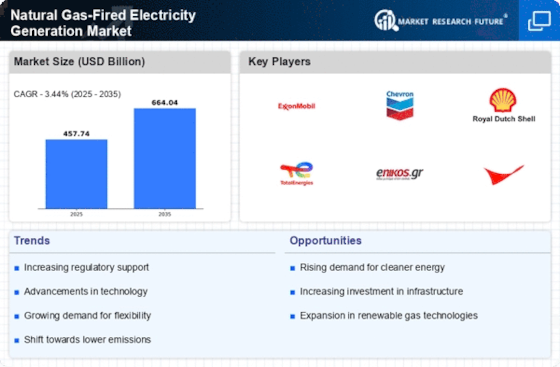

Regulatory Support and Policy Frameworks

The Natural Gas-Fired Electricity Generation Market benefits from supportive regulatory frameworks that promote cleaner energy sources. Governments are increasingly implementing policies that favor natural gas as a transitional fuel towards a low-carbon future. For instance, various countries have established incentives for natural gas infrastructure development, which enhances market attractiveness. In 2023, natural gas accounted for approximately 40% of electricity generation in several regions, indicating a strong reliance on this energy source. Such regulatory support not only encourages investment but also fosters innovation within the industry, potentially leading to more efficient generation technologies.

Growing Demand for Reliable Energy Sources

The Natural Gas-Fired Electricity Generation Market is experiencing a surge in demand for reliable and flexible energy sources. As economies expand, the need for consistent electricity supply becomes paramount. Natural gas plants can quickly ramp up or down to meet fluctuating demand, making them an ideal complement to intermittent renewable energy sources like wind and solar. In 2023, natural gas generation capacity increased by 5% in response to rising electricity demand, highlighting its role in ensuring grid stability. This growing reliance on natural gas underscores its importance in the energy mix.

Economic Viability and Cost Competitiveness

The Natural Gas-Fired Electricity Generation Market is characterized by its economic viability, particularly in comparison to other fossil fuels. The cost of natural gas has remained relatively stable, making it an appealing option for electricity generation. In recent years, the levelized cost of electricity (LCOE) from natural gas has been competitive with coal and even some renewable sources, depending on regional market conditions. This cost-effectiveness is crucial as it allows utilities to maintain affordable electricity prices while transitioning to cleaner energy sources. As a result, the industry is likely to see continued growth driven by economic factors.

Environmental Considerations and Emission Reductions

Environmental concerns are increasingly influencing the dynamics of the Natural Gas-Fired Electricity Generation Market. Natural gas is often viewed as a cleaner alternative to coal, with lower carbon emissions when combusted. As countries strive to meet international climate commitments, the shift towards natural gas is seen as a viable strategy for reducing overall greenhouse gas emissions. In 2023, natural gas generation contributed to a 20% reduction in emissions compared to coal-fired generation. This trend suggests that the industry will continue to grow as stakeholders prioritize sustainability and environmental responsibility.

Technological Innovations in Extraction and Generation

Technological advancements play a pivotal role in the Natural Gas-Fired Electricity Generation Market. Innovations in extraction techniques, such as hydraulic fracturing and horizontal drilling, have significantly increased the availability of natural gas. Furthermore, improvements in combined cycle gas turbine (CCGT) technology have enhanced the efficiency of electricity generation. These advancements have led to a reduction in greenhouse gas emissions per unit of electricity produced, making natural gas a more environmentally friendly option. As technology continues to evolve, the industry may experience further enhancements in efficiency and sustainability.