Nanotechnology Packaging Size

Nanotechnology Packaging Market Growth Projections and Opportunities

The Nanotechnology Packaging Market is a dynamic industry influenced by various factors. Advanced packaging solutions are required in all industries and this is the main factor to consider when looking into it. Traditional packaging methods, on the other hand, cannot meet such new needs of areas like electronics, healthcare, and food and beverages due to nanotechnology as a game changer. Hence the packaging industry has developed high demand for nanomaterials that can improve barrier properties, extend shelf life and enhance overall product performance.

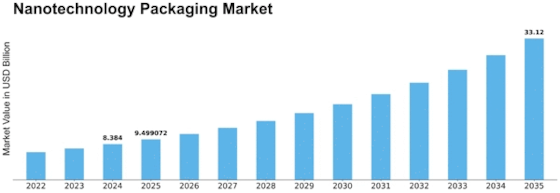

The market size of the Nanotechnology Packaging was valued at USD 6.5 Billion in 2022. The compound annual growth rate (CAGR) is projected to be 13.30% from USD 7.4 Billion in 2023 to USD 20 billion by 2032.

Further still, rapid development of nanomaterials boosts growth within Nanotechnology Packaging Market as well. This research leads to innovative materials with improved characteristics at nano scale thereby generating higher performance products for specific applications such as for instance; packages.The landscape of nanotech technologies keeps changing hence assuring an ever-changing market place.

Also government regulations influence how fast or slow he Nanotechnology Packaging Market grows. Governments across most countries have started addressing any concerns related to nanopackaging regulations.This framework not only addresses health concerns but also standardizes manufacturing practices whose compliance becomes crucial for any entrant who wishes to become part of this sector.

Additionally, consumer awareness and preference is another important market factor affecting adoption of nano technologies in packaging . In modern societies people understand that wrapping substances may bear environmental consequences along with human health effects.Growing consciousness in this regard results therefore that there comes greater demand virtually everywhere else except where one package is used when sustainable measures have been taken into account during its production process.Nanotech technology has been adopted by consumers wishing environmentally friendly-safe package alternatives through which increasing business opportunities arise.

Leave a Comment