Regulatory Support

Regulatory support is emerging as a vital driver for The Global Nanocomposites Industry. Governments worldwide are increasingly recognizing the potential of nanocomposites in promoting sustainability and innovation. Policies aimed at encouraging the development and use of advanced materials are being implemented, which can facilitate research and development initiatives. For instance, funding programs and grants for nanotechnology research are becoming more prevalent, thereby fostering innovation in the field of nanocomposites. This regulatory backing not only enhances the credibility of nanocomposite materials but also encourages manufacturers to invest in their development. As a result, the market is likely to experience accelerated growth, with projections indicating a significant increase in market size over the next few years. Thus, regulatory support is a crucial element driving the expansion of The Global Nanocomposites Industry.

Sustainability Focus

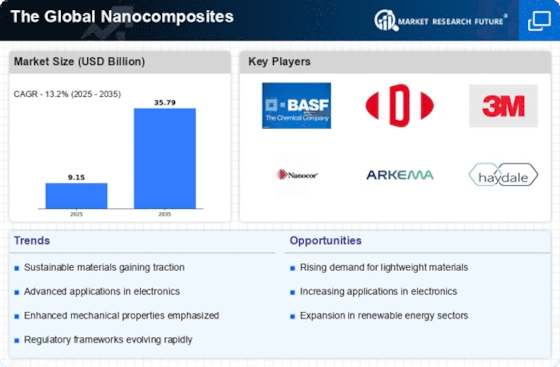

The increasing emphasis on sustainability is a pivotal driver for The Global Nanocomposites Industry. As industries strive to reduce their environmental footprint, nanocomposites offer a promising solution due to their enhanced properties and reduced material usage. For instance, nanocomposites can lead to lighter and stronger materials, which in turn can improve fuel efficiency in automotive applications. The market for nanocomposites is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This growth is largely attributed to the rising demand for eco-friendly materials across various sectors, including packaging, construction, and automotive. Consequently, the sustainability focus not only aligns with regulatory requirements but also meets consumer preferences for greener products, thereby propelling The Global Nanocomposites Industry forward.

Technological Advancements

Technological advancements play a crucial role in shaping The Global Nanocomposites Industry. Innovations in manufacturing processes, such as improved dispersion techniques and enhanced polymer matrix formulations, have led to the development of high-performance nanocomposites. These advancements enable the production of materials with superior mechanical, thermal, and electrical properties, which are increasingly sought after in industries like electronics and aerospace. For example, the integration of nanomaterials in electronic devices has resulted in lighter, more efficient components. The market is expected to witness a surge in demand for these advanced materials, with projections indicating a market size reaching several billion dollars by the end of the decade. Thus, continuous technological progress is likely to drive the expansion of The Global Nanocomposites Industry, fostering innovation and competitiveness.

Increased Application Scope

The increased application scope of nanocomposites is a significant driver for The Global Nanocomposites Industry. As industries explore new uses for these materials, the versatility of nanocomposites becomes evident. They are being utilized in diverse fields such as automotive, aerospace, electronics, and healthcare. For instance, in the automotive sector, nanocomposites are employed to enhance fuel efficiency and reduce emissions. In healthcare, they are used in drug delivery systems and medical devices, showcasing their potential to revolutionize various applications. The market is anticipated to expand as more sectors recognize the benefits of incorporating nanocomposites into their products. This trend is expected to contribute to a robust growth trajectory, with estimates suggesting a market valuation that could exceed several billion dollars in the near future. Therefore, the broadening application scope is a key factor driving The Global Nanocomposites Industry.

Consumer Demand for High-Performance Materials

Consumer demand for high-performance materials is a driving force behind The Global Nanocomposites Industry. As end-users seek products that offer enhanced durability, lightweight characteristics, and superior performance, nanocomposites are increasingly being recognized as a viable solution. Industries such as automotive and construction are particularly influenced by this demand, as they require materials that can withstand harsh conditions while maintaining efficiency. The market is projected to grow substantially, with estimates suggesting a compound annual growth rate of over 15% in the coming years. This growth is fueled by the need for innovative materials that can meet the evolving expectations of consumers. Consequently, the rising consumer demand for high-performance materials is likely to propel The Global Nanocomposites Industry into a new phase of expansion.