Rising Healthcare Expenditure

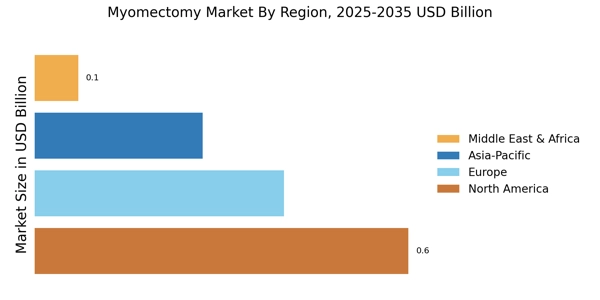

The upward trend in healthcare expenditure is a significant driver for the Myomectomy Market. As countries invest more in healthcare infrastructure and services, access to surgical procedures, including myomectomy, is improving. Increased healthcare spending often correlates with better patient outcomes and higher rates of surgical interventions. This trend is particularly evident in regions where healthcare reforms are being implemented to enhance women's health services. The Myomectomy Market stands to benefit from this increased investment, as more women gain access to necessary treatments for uterine fibroids. Furthermore, as healthcare systems evolve to prioritize patient-centered care, the demand for effective surgical options like myomectomy is expected to rise.

Increasing Awareness and Education

There is a notable increase in awareness and education regarding women's health issues, particularly concerning uterine fibroids. This trend is significantly influencing the Myomectomy Market. Educational campaigns and initiatives by healthcare organizations are helping women understand the implications of fibroids and the available treatment options, including myomectomy. As women become more informed about their health, they are more likely to seek medical advice and consider surgical options. This heightened awareness is expected to drive demand for myomectomy procedures, as women prioritize their reproductive health. Additionally, the Myomectomy Market may see growth as healthcare providers enhance their outreach efforts, leading to an increase in consultations and subsequent surgical interventions.

Growing Prevalence of Uterine Fibroids

The increasing incidence of uterine fibroids is a primary driver of the Myomectomy Market. Research indicates that approximately 70 to 80% of women develop fibroids by the age of 50. This rising prevalence necessitates effective treatment options, with myomectomy being a preferred choice for many women seeking to preserve their uterus. The demand for myomectomy procedures is likely to grow as awareness about fibroids and their symptoms increases. Furthermore, the Myomectomy Market is expected to benefit from the rising number of women seeking medical intervention for fibroid-related complications, which can include heavy menstrual bleeding and pelvic pain. As healthcare providers continue to educate patients about available treatment options, the market for myomectomy is poised for expansion.

Growing Demand for Fertility Preservation

The rising demand for fertility preservation among women is emerging as a crucial driver in the Myomectomy Market. Many women diagnosed with uterine fibroids are concerned about their reproductive health and future fertility. Myomectomy Market, which aims to remove fibroids while preserving the uterus, is increasingly viewed as a viable option for women wishing to maintain their fertility. This trend is particularly pronounced among younger women who are delaying childbirth for various reasons. As awareness of fertility preservation options grows, the Myomectomy Market is likely to see an increase in procedures performed. Additionally, healthcare providers are increasingly recognizing the importance of addressing fertility concerns, further driving the demand for myomectomy as a treatment option.

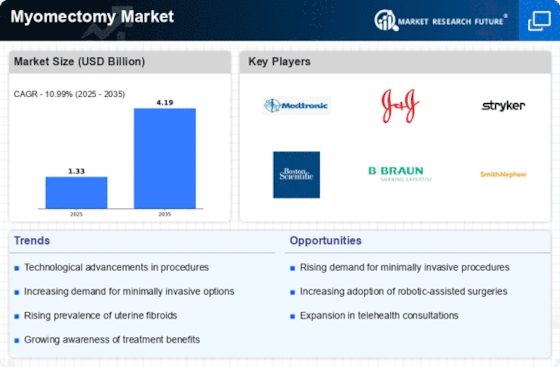

Technological Innovations in Surgical Techniques

Technological advancements in surgical techniques are transforming the Myomectomy Market. Innovations such as robotic-assisted surgery and laparoscopic procedures are enhancing the precision and safety of myomectomy. These advancements not only reduce recovery times but also minimize complications, making myomectomy a more attractive option for patients. The integration of advanced imaging technologies allows for better preoperative planning and intraoperative navigation, further improving surgical outcomes. As these technologies become more widely adopted, the Myomectomy Market is likely to experience growth, driven by both patient demand for less invasive options and surgeon preference for enhanced surgical tools. The ongoing development of new techniques may also lead to an increase in the number of procedures performed.