Multi Layer Cryogenic Insulation Size

Multi Layer Cryogenic Insulation Market Growth Projections and Opportunities

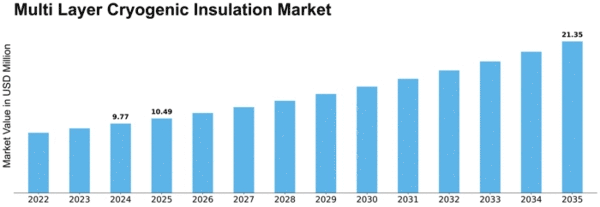

The Multi-layer cryogenic insulation market is projected to be worth USD 1,522.78 million by 2028, registering a CAGR of 6.70% during the forecast period (2020–2028). The market was valued at USD 924.43 million in 2020.

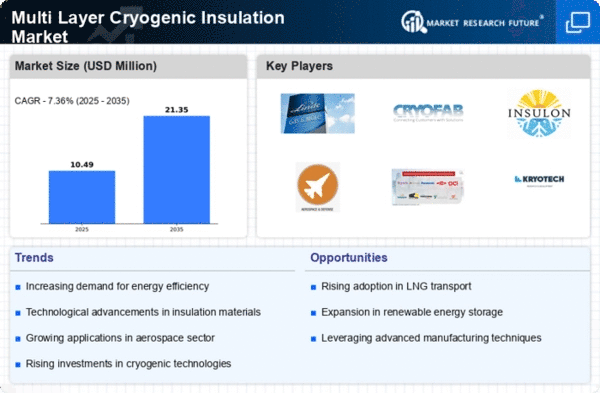

The Multi-Layer Cryogenic Insulation Market is influenced by a variety of factors that together shape its growth and dynamics. A key factor here is the growth in demand for advanced insulation solutions in industries such as energy, aerospace and health care where there are high usage of cryogenic applications. Multilayer cryogenic insulations systems made up of foam materials, reflective foils and vacuum layers are significant because they have highest degree of thermal performance which maintains very low temperatures.

In spacecraft design, satellites and space probes where cryogenic propellants and components are necessary for their preservation, these insulation systems find application. This has increased interest in research on space development; satellite launching as well as other space activities hence leading to multiplicity of uses for multi-layered insulators.

Moreover the multi-layer cryogenic insulation market is heavily driven by the energy sector especially with regards to storing and moving around liquified natural gas (LNG) among other chemicals. Heat ingress prevention is one of the critical roles played by insulation so as to maintain low temperatures necessary for storing and transporting cryogenic liquids. As LNG industry grows in response to increasing clean energy sources demand so does need for efficient and dependable cryogenics insulations systems.

Another major player shaping multi-layer cryogenic insulation market is healthcare industry. In medical applications, an adequate level of protection must guarantee safe transportation or maximum temperature control which includes biological samples and vaccines that can easily be affected by extreme conditions used during their storage process known as “cryopreservation”. For biological materials safety maintenance purposes modernized freezing devices like ultra-low temperature freezers or even just cryogenic containers heavily rely on cutting-edge insulation technologies. Development in medical research, pharmaceuticals and biotechnology entities are some of the reasons why these areas are contributing to a very high demand of highly efficient cryogenics insulations.

However, cost factors, material selection issues and safety laws might hinder the multi-layer cryogenic insulation industry. Cryogenic insulation requires specialized materials and designs which make it more expensive compared to conventional insulation systems. In consideration of total lifecycle costs against performance advantages associated with advanced cooling materials the manufacturers or end-users make informed choices about investing into sophisticated cryogenic insulations. Furthermore, when choosing multilayered cryogenics for example it is important to ensure that they are compatible with the fluids used at extreme cold temperatures in addition to meeting strict safety regulations.

Leave a Comment