Technological Innovations

Technological advancements play a pivotal role in shaping the Motorcycle High-Performance Braking System Market. Innovations such as anti-lock braking systems (ABS) and electronic braking systems (EBS) are becoming increasingly prevalent, offering enhanced control and stability during braking. These technologies are particularly appealing to performance-oriented riders who seek superior handling and safety. The integration of smart technologies, including connectivity features that allow for real-time monitoring of braking performance, is also gaining traction. As manufacturers continue to invest in cutting-edge technologies, the market is expected to witness a surge in demand for high-performance braking systems, with projections indicating a potential market size increase of over 20% in the next five years. This trend underscores the importance of technological innovation in driving growth within the Motorcycle High-Performance Braking System Market.

Growing Popularity of Motorcycles

The Motorcycle High-Performance Braking System Market is benefiting from the growing popularity of motorcycles as a preferred mode of transportation. Urbanization and increasing traffic congestion have led many consumers to consider motorcycles as a practical alternative to cars. This shift in consumer behavior is driving demand for high-performance braking systems, as riders seek enhanced safety and performance. In recent years, motorcycle sales have seen a steady increase, with a reported rise of approximately 8% in unit sales in key markets. As more individuals take to the roads on motorcycles, the need for reliable and efficient braking systems becomes paramount. Consequently, manufacturers are focusing on developing high-performance braking solutions that cater to this expanding consumer base, thereby propelling growth in the Motorcycle High-Performance Braking System Market.

Rising Demand for Safety Features

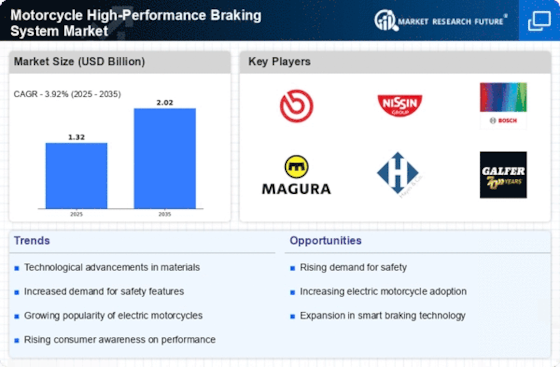

The Motorcycle High-Performance Braking System Market is experiencing a notable increase in demand for advanced safety features. As consumers become more safety-conscious, manufacturers are compelled to integrate high-performance braking systems that enhance stopping power and reduce stopping distances. This trend is particularly evident in regions where motorcycle accidents are prevalent, prompting regulatory bodies to advocate for improved safety standards. The market for high-performance braking systems is projected to grow at a compound annual growth rate of approximately 6% over the next five years, driven by this heightened focus on safety. Consequently, manufacturers are investing in research and development to innovate braking technologies that not only meet but exceed safety regulations, thereby positioning themselves competitively in the Motorcycle High-Performance Braking System Market.

Regulatory Compliance and Standards

The Motorcycle High-Performance Braking System Market is significantly influenced by regulatory compliance and evolving safety standards. Governments across various regions are implementing stricter regulations regarding motorcycle safety, which includes mandates for advanced braking systems. These regulations are designed to reduce accident rates and enhance rider safety, thereby creating a robust demand for high-performance braking solutions. Manufacturers are increasingly required to adapt their products to meet these stringent standards, which often necessitates investment in research and development. As a result, the market is likely to see a shift towards more innovative braking technologies that comply with regulatory requirements. This trend not only fosters competition among manufacturers but also drives growth in the Motorcycle High-Performance Braking System Market, as companies strive to meet and exceed these evolving standards.

Increased Focus on Performance and Customization

The Motorcycle High-Performance Braking System Market is witnessing a surge in consumer interest in performance and customization options. Enthusiasts are increasingly seeking high-performance braking systems that not only enhance the overall riding experience but also allow for personalization. This trend is particularly pronounced among sportbike riders who prioritize performance upgrades. Manufacturers are responding by offering a range of customizable braking solutions, including various materials and designs that cater to individual preferences. The market for aftermarket high-performance braking systems is projected to grow significantly, with estimates suggesting a potential increase of 15% in the next few years. This focus on performance and customization is driving innovation within the Motorcycle High-Performance Braking System Market, as companies strive to meet the diverse needs of their customers.